While located in the European heartland geographically, Switzerland takes exception in many ways because of its permanent neutrality. This is true even when it comes to logistics. The Swiss logistics sector is mainly focused on handling the domestic flow of (imported and exported) goods, which is comparatively voluminous because of the country’s high purchasing power and strong industry. Yet due to its high labour costs, property prices and operating costs, Switzerland does not act as an international hub for the movement of material goods.

Its logistics sector is mainly made up of freight carriers and transport companies that are domiciled in Switzerland. Most manufacturing companies operate their own logistics arms. So, the owner-occupied share of logistics real estate is disproportionately high. But given the growing complexity of logistics processes, the trend to outsource logistics services to third parties is evident even in Switzerland. Another peculiarity is the ban on inland transport, meaning that no foreign company is permitted to provide domestic transport services on routes located entirely in Switzerland.

The market volume of the Swiss logistics sector is estimated to total c. EUR 44.4 billion or the equivalent of around 6% of the gross domestic product by the end of 2023. This compares to EUR 300 billion and a GDP share of 8% in Germany. Logistics-related jobs in Switzerland accounted for close to 186,000 employees in 2021. Again, the percentage (3.7% of all gainfully employed persons) is lower than in Germany (5.3%).

The high proportion of owner-occupiers is reflected in the fact that institutional investors are responsible for only 10-20% of the building investments in the logistics real estate sector. For the sake of comparison: The institutional share in office real estate investments is about 30-50%. As a result, there are barely 300 investment-grade logistics properties nationwide (JLL, 2022). The entire floor space stock equals around 26 million sqm (CBRE, 2021), the cantons with the highest proportions thereof being Basel (4.0m sqm), Bern (3.5m sqm), Zurich and Aargau (2.9m sqm each).

Due to the low number of rental properties and the scant availability of development land, the Swiss building stock has a relatively high age average of about 30 years. Above all, modern logistics facilities that meet current occupier needs are generally in short supply.

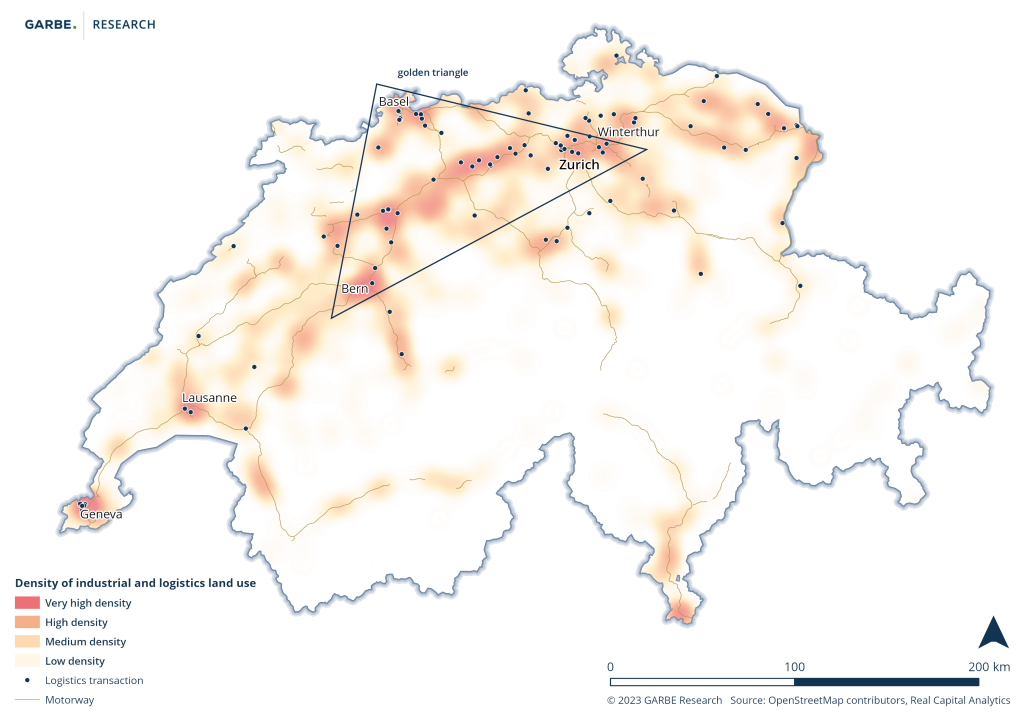

Conurbations tend to be important bases for the logistics sector because of their proximity to sales and procurement markets, their labour pool and their dense road and rail networks. This is true for Switzerland, too. Its industrial and logistics belt runs the entire length of the Central Plateau, i. e. the densely populated region between Lake Constance and Geneva. The Central Plateau is also home to the country’s economic centres. The “golden triangle” formed by the cities of Basel, Zurich and Bern boasts a very high density of industrial and logistics facilities, especially along the A1 motorway between Zurich and Bern.

Figure: Industrial and logistics real estate density and the locations of logistics properties of 5,000 sqm or more that have been sold in Switzerland since 2015

The competition for large-scale development land is particularly fierce in the metro areas. Developable properties for larger logistics centres with convenient transportation access and with emission options are virtually unavailable on the Swiss market and are rarely ever zoned by Swiss municipalities. Municipal authorities often take a rather restrictive planning-law view of commercial types of use, hoping to keep emissions to a minimum while maximising the job density. Things are not made easier by the Swiss topography, which in many places rules out large-scale logistics facilities. Indeed, the land shortage is generally one of the biggest obstacles besetting the Swiss logistics real estate market. Companies have responded by shifting their focus to locations outside the established logistics hotspots. These are frequently the only places where new-build construction is feasible at all.

Just like in other European countries, the need for logistics space in Switzerland has been growing for several years. It outpaces available supply by far, so that the situation can be safely described as pent-up demand. During the years 2017 through 2021, around 200,000 sqm of new-build logistics space, either brownfield or greenfield, were completed on average (CBRE, 2021). But most of these completions represent small-scale units for owner-occupancy. Rental properties of 5,000 sqm or larger accounted for less than 5% of the completions volume in 2021. Rarely ever do investors engage in speculative developments. So, the situation has predictably resulted in a low vacancy rate that amounted to 2.0% of the total stock in 2022.

The highest prices are paid in Zurich where the prime rent for modern logistics facilities was EUR 20.50/sqm at the last count. In Geneva, the going rate for comparable rental units is EUR 17.50/sqm, while the rate for prime locations in Basel is EUR 15.00/sqm. This compares to a prime rent of barely EUR 10.00/sqm in Munich, which is Germany’s priciest logistics real estate market. However, the difference between German and Swiss logistics markets is put into perspective by the fact that price levels are generally higher in Switzerland.

The very restrictive zoning of new development land and the generally short supply in rental units has caused prime rents to keep going up steadily in recent years. Over the past three years, prime rents in these three top markets increased between 17 and 25%. Going forward, the strained market situation makes it safe to assume that rent rates will continue to increase.

The past few years have seen the asset class of logistics real estate move increasingly into focus for those investors who are seeking to diversify their portfolios. What prompted them to perceive logistics real estate as a generally safe and stable investment with development potential was not least the pent-up demand. Yet the investment market for this asset class is comparatively small because of its limited number of investment-grade assets. In recent years, the number of transactions worth EUR 10 million or more have averaged ten per year.

The total transaction volume has averaged EUR 450 million annually, although the year-end totals have varied significantly because of the low number of transactions. Yet the market action appears to have gathered momentum over time, starting in 2013. Last year, the investment market actually achieved a record level. Then again, the reticence lately shown by investors across Europe was also visible in Switzerland. Sales this year to date have added up to merely EUR 62 million.

Figure: Transaction volume of logistics properties in Switzerland 2007-2023*

Even in Switzerland, the terms of financing have seriously changed since spring of 2022, albeit less drastically than elsewhere. The key lending rate was incrementally raised by 250 basis points, up to 1.75%. During the same period of time, the ECB’s key lending rate rose by 450 basis points. Yield decompression therefore progressed at a more moderate pace in Switzerland. In the time since the trough of May 2022, prime yields nationwide went up by 60 basis points, compared to an increase by 100 basis points in Germany.

By mid-year 2023, the net initial yield for prime assets equalled 4.40% in Zurich and 4.60% in Geneva. This means they topped the prime yields for German logistics hotspots by about 40 basis points. In Basel, prime yields stood at 5.20%. Yield rates stabilised during the third quarter.

Speculative or built-to-suit project developments are rather rare due to the often restrictive planning laws and the high land and implementation costs.

The Swiss investment market for logistics real estate is comparatively small due to the generally high cost structure and the high proportion of owner-occupiers. Speculative or built-to-suit developments are quite rare as a result of the frequently restrictive Swiss planning law and because of the high land prices and implementation costs. At the same time, the real estate stock is 30 years old on average and thus often out of touch with present-day user requirements. It would take substantial capital expenditures to make the Swiss logistics stock fit for the future.

Significant investment potential is also generated by the need to reposition standing properties in line with ESG criteria, an aspect that keeps gaining in importance in Germany as well. The trend to outsource logistics processes to 3PL service providers could motivate property holders to put formerly owner-occupied assets on the market. Indeed, standing properties in general could qualify as an attractive investment because of the strong demand for space and the sound economic conditions in Switzerland.

We use cookies on our site. Some of them are essential, while others help us to improve this website and to show you personalised advertising. You can either accept all or only essential cookies. To find out more, read our privacy policy and cookie policy. If you are under 16 and wish to give consent to optional services, you must ask your legal guardians for permission. We use cookies and other technologies on our website. Some of them are essential, while others help us to improve this website and your experience. Personal data may be processed (e.g. IP addresses), for example for personalized ads and content or ad and content measurement. You can find more information about the use of your data in our privacy policy. You can revoke or adjust your selection at any time under Settings.

If you are under 16 and wish to give consent to optional services, you must ask your legal guardians for permission. We use cookies and other technologies on our website. Some of them are essential, while others help us to improve this website and your experience. Personal data may be processed (e.g. IP addresses), for example for personalized ads and content or ad and content measurement. You can find more information about the use of your data in our privacy policy. This is an overview of all cookies used on this website. You can either accept all categories at once or make a selection of cookies.