The European logistics real estate market remains lively despite the current economic conditions. Investors active in this market focus primarily on the major markets, such as Germany, the UK, France and the Netherlands. One country that tends to be overlooked in this context by many investors is Belgium. Its market has so far been dominated by owneroccupancy, yet it is gaining in appeal due to its geographic location in the heartland of Europe and because of the strong demand for space in what is an economically robust region.

Sustained strong demand, low vacancy rates and a shortage in building plots in many regions have been driving up rent rates. It is a trend that has been further accelerated by recent increases in construction and financing costs. On the whole, these aspects seriously enhance the attractiveness of this asset class, although investors have been rather reticent lately about investing in logistics real estate due to the changed parameters on the capital market.

Europe’s leading logistics real estate markets are Germany, the United Kingdom, France and the Netherlands. The bulk of logistics real estate investments is transacted in these countries. Yet one market that is often overlooked by Europe-wide investors even though it lies in the centre of the “Blue Banana” is Belgium. The country with its population of roughly 11.6 million inhabitants maintains close interdependencies with its neighbours. While its economic strength is high overall, there are stark differences from one region to the next. The Brussels metro area and Flanders, for instance, are home to a large number of hightech manufacturing companies and knowledgeintensive services, whereas Wallonia is still strongly defined by the structural change of its coal and steel industry.

Belgium has been an important trading and manufacturing location since the middle ages, and it remains a major transshipment centre. The port of Antwerp-Bruges counts among the most important seaports in Europe, second only to Rotterdam, and it plays a key role even for German companies. The latter group accounted for nearly 30 percent of the port’s transshipment total at the last count. Belgium boasts an attractive infrastructure, including a very dense road and rail network. In addition to the two major seaports, there are also numerous inland waterways used for commerce. The most important transshipment centres for air cargo are the airports in Brussels (Zaventem) and Liège.

The logistics sector plays an important role for the economic and commerce of Belgium. The country has a highly developed logistics industry that provides a wide spectrum of related services. The industry is particularly well-established in the Flanders region where it accounts for a major share of the GDP. On top of that, a large number of international corporates chose Belgium for setting up their European logistics centres.

The stock of light industrial and logistics real estate adds up to around 44.1 million sqm as of the first quarter of 2023, of which 70 % is located in Flanders, and about 15 % each in the Brussels metro area and Wallonia. In the years since 2019, the property stock in this segment has grown by about 14 %. Despite the enormous increase in building area added in recent years, the vacancy rate has declined steadily and was down to a mere 0.9 % today.

This is explained by the persistently strong demand for space, which has continued to set ever new records in recent years. The annual take-up over the past ten years averaged 1.73 million sqm, which breaks down into a take-up of 1.39 million sqm during the first half and 2.06 million sqm during the second half. Despite the economic jitters, take-up suffered only a modest decline in 2022, and even the first quarter of 2023 ended up generating a take-up of about 330,000 sqm, a level in line with the longerterm average. The keen demand was reflected in a steep increase in prime rents. In the logistics regions of Brussels and Antwerp, they rose by about one third each in the years since 2013.

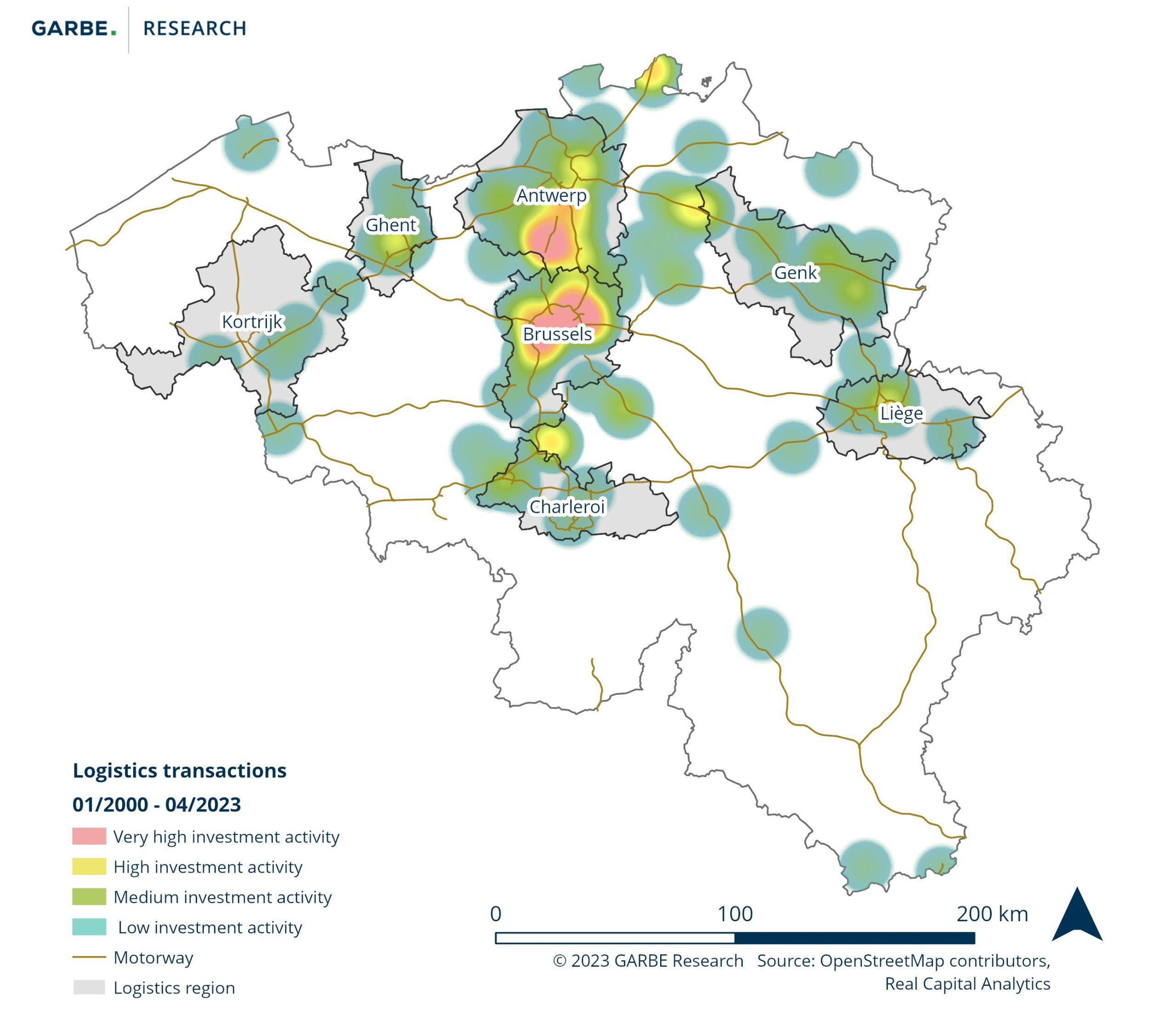

A comparison with the Netherlands reveals that the Belgian logistics real estate market is dominated by owner-occupied properties. This results in a significantly smaller investment market. The annual average of 20 transactions registered in Belgium contrasts starkly with a transactions total of about 195 in the Netherlands. The investment volume in Dutch logistics real estate is roughly eight times as high as that in Belgium. The average volume of sales transacted in Belgium over the past ten years is 350 million euros per year, with the past three years claiming the highest results. Investment activities focus on the two biggest cities, Brussels and Antwerp, plus on the corridor between the two metropolises. To a lesser extent, they concentrate on other Flemish regions, such as Ghent and Genk. The number of investments in Wallonia has been low in recent years.

Belgium’s investment market for logistics and industrial properties have seen strong yield compression in recent years. In Brussels and Antwerp, it declined from around 7.00% in either city in 2013 down to 4.60% and 4.50%, respectively, at the last count. For the sake of comparison: This puts them above comparables in top markets of neighbouring countries like Germany (3.40%) and the Netherlands (4.20%). In response to geopolitical and financial policy parameters, yields softened noticeably in all of the three prime markets analysed during the second half of 2022.

Belgium’s centrality within western Europe and its well-developed infrastructure make it a highly attractive location. Due to its geographic proximity to other major European sales markets and to the seaports of Antwerp and Bruges, Belgium is a significant logistics site with plenty of potential.

The country is also home to a strong economy, its sector foci including the automotive industry, mechanical engineering, and food processing. These are industries that require logistics and warehousing units for the purpose of storing and distributing their products. Demand for logistics real estate in Belgium is increasing due to the growth of e-commerce and the rising significance of supply chain optimization. Add to this the planned investments in renewable energies, for instance in the form of offshore wind parks along the Belgian seaboard. The requirements that logistics infrastructure is facing keeps getting more complex and presuppose greater flexibility and efficiency.

The Belgian logistics real estate market offers investors attractive conditions, as logistics real estate is subject to growing demand while remaining in short supply. It is a situation that ensures rising rents and higher cash-on-cash returns. All things considered, the Belgian logistics real estate market presents a promising opportunity for investors to benefit from a favorable geographic location that combines with a robust economy and a growing demand for logistics real estate.

We use cookies on our site. Some of them are essential, while others help us to improve this website and to show you personalised advertising. You can either accept all or only essential cookies. To find out more, read our privacy policy and cookie policy. If you are under 16 and wish to give consent to optional services, you must ask your legal guardians for permission. We use cookies and other technologies on our website. Some of them are essential, while others help us to improve this website and your experience. Personal data may be processed (e.g. IP addresses), for example for personalized ads and content or ad and content measurement. You can find more information about the use of your data in our privacy policy. You can revoke or adjust your selection at any time under Settings.

If you are under 16 and wish to give consent to optional services, you must ask your legal guardians for permission. We use cookies and other technologies on our website. Some of them are essential, while others help us to improve this website and your experience. Personal data may be processed (e.g. IP addresses), for example for personalized ads and content or ad and content measurement. You can find more information about the use of your data in our privacy policy. This is an overview of all cookies used on this website. You can either accept all categories at once or make a selection of cookies.