GARBE PYRAMID MAP: Skyrocketing Rents in Europe Underline the Resilience of the Asset Class of Logistics Real Estate

News 06/09/2022

- 70 percent of the European and 90 percent of the German logistics real estate have experienced rent price rallies since the end of the second half of 2021

- Despite strong investment demand, the yield compression is stalled, and European prime markets are actually seeing a trend reversal

- Demand for space maintains a constant high level despite the crises, with in-, re- and near-shoring generating added potential

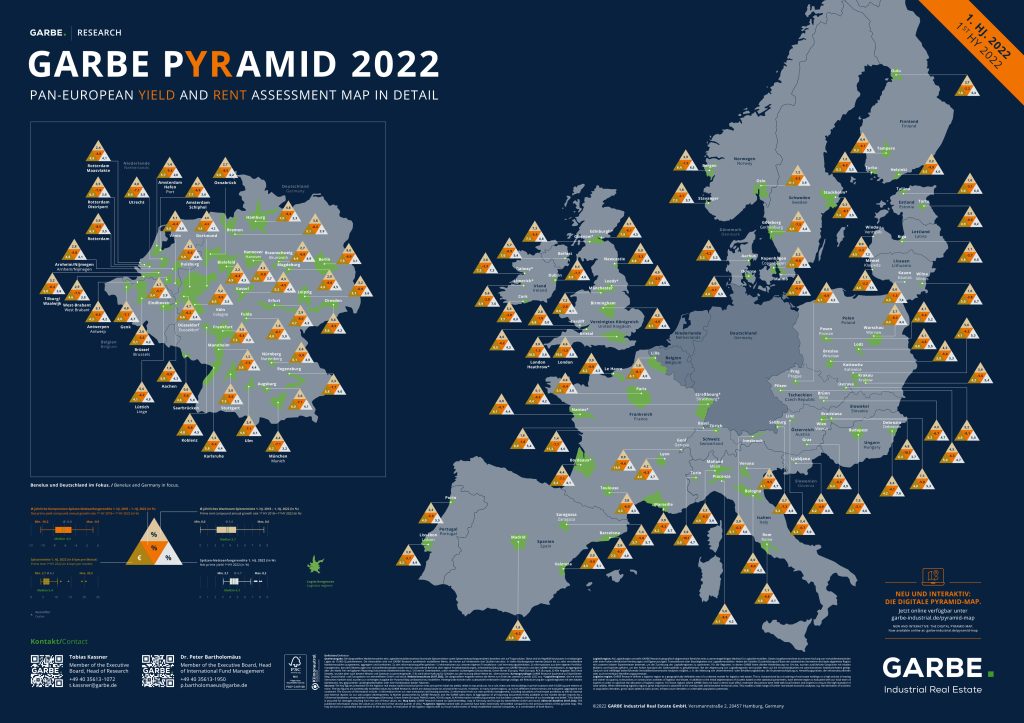

Hamburg, 6 September 2022. Demand for logistics real estate is not slowing in Europe, driving significant upward price growth. This development is further fuelled by increased construction and financing costs in the new-build segment. Overall, 70 percent of the examined European markets registered substantial growth since the end of the second half of 2021, whereas 30 percent saw no change in rent levels. The remarkable thing being: No region reported negative rental growth. These are some of the findings GARBE Research presented in its latest GARBE PYRAMID MAP, the 2022 mid-year update of the company’s yield and rent map for the 122 most important logistics real estate submarkets in 23 European countries.

Especially Manchester (0.80 euros/sqm/month), Newcastle (0.70 euros/sqm/month), London-Heathrow, Cologne and Prague (0.60 euros/sqm/month each) reported a particularly brisk rental uplift during the first half of 2022. “Since the end of the second half of 2021, rents in the examined 122 European logistics regions increased by an average of 20 cents/sqm,” said Tobias Kassner, Head of Research and member of the Management Board at GARBE.

The trend presents an even clearer picture in Germany: Here, rents have gone up in 90 percent of the 29 German submarkets since the end of the second half of 2021. Ten percent of the market registered no changes during this time. The fastest rental uplift was reported in Cologne (0.6 euros/sqm/month), in Berlin, Duisburg, Dortmund, Munich (0.5 euros/sqm/month each), as well as in Hamburg, Kassel and Düsseldorf (0.4 euros/sqm/month each).

Kassner commented: “In Germany, the persistent shortage of space and the strong unrelieved demand are tremendous drivers that keep boosting the rent growth. The average prime rent in Germany has increased by 20 cents/sqm/month since the end of the second half of 2021, and by an actual 40 cents/sqm/month in the Big Seven markets.”

According to GARBE, demand for logistics facilities remains as high as ever. The bread-and-butter business alone has generated strong demand for space, but it is further fuelled by additional potential from the trends toward in-shoring (relocating business sites because of adverse parameters in the home country), re-shoring (repatriation of the company from an emerging economy back to the country of origin) and near-shoring (relocating the business operation into a neighbouring country) by e-commerce and by expanded warehousing.

The keen demand is also reflected in a very lively transaction activity on the national and European levels. But even the logistics real estate market was impacted by the shifts in political and economic parameters such as inflation, disrupted supply chains, intensified risk assessments and high financing costs.

For the first time since the first edition of GARBE PYRAMID was published (second half‑year of 2020), some markets have seen their prime net initial yields soften. Around 22 percent of the examined European markets have recorded rising yields since the end of the second half of 2021. Decompression was noted above all in leading European markets like London (0.6 percent), Birmingham and London-Heathrow (both 0.3 percent). These are markets that had already achieved a very high price level. Conversely, yields remained stable in 34 percent of the European markets, while yield compression continued in 44 percent of the markets prior to the outbreak of war in Ukraine. This was true specifically for markets like Geneva (-1.0 percent), Piacenza (‑0.9 percent), Verona and Turin (-0.7 percent).

Germany presents a similar picture: The yield compression in 31 percent of the 29 German submarkets experienced a trend reversal since the end of the second half of 2021. Notable cases in point were primarily the Big Seven markets (Berlin, Cologne, Düsseldorf, Frankfurt, Hamburg, Munich and Stuttgart) as well as Duisburg and Erfurt (0.1 percent). At the same time, yields flatlined in 66 percent of the German markets. Only the Bielefeld logistics region—representing 3 percent of the German markets—continued to see a further hardening of yield rates.

Jan Dietrich Hempel, Managing Director of GARBE Industrial Real Estate, analysed the changed market situation: “Globalisation itself is under scrutiny now. Supply chain changes caused by the war in Ukraine and by the zero-COVID policy in China has forced company to search for ways to move production close to their point of sales and to build up inventory levels in order to remain competitive.” And Hempel added: “The shrinking supply of space is now generating demand for secondary and tertiary cities. On the whole, however, it is quite obvious that the logistics real estate market continues to follow a very robust trend and remains attractive for investors across Europe.”

Outlook

As far as the future development goes, it is now reasonable to assume that the average European prime rent will probably keep going up by another 10 cents/sqm/month before the end of 2022. In fact, a further growth by 20 cents/sqm/month by the end of 2023 is entirely possible. As a result, the average rent rate could approximate 6.30 euros/sqm/month by the second half of 2023.

We expect the average prime rent in Germany’s Big Seven markets to keep gaining another 20 cents/sqm/month before the end of 2022. There is a good chance they will rise by a further 30 cents/sqm/month by the end of 2023. This means that the average rent rate could equal c. 7.60 euros/sqm/month by the second half of 2023.

The current market situation is subject to such strong fluctuations that it does not lend itself to the derivation of verifiable forecasts of future prime net initial yields at the moment. Principally speaking, we expect the economic situation to ease in early 2023.

For more figures and methodological details, please see the interactive GARBE PYRAMID MAP. The data referenced in our press release are sourced from the PYRAMID project.