GARBE PYRAMID-MAP: Record-Level Demand Keeps Driving up European Logistics Rents

News 02/02/2023

Hamburg, 02 February 2023. Despite the various geopolitical crises, the demand for space in logistics properties remained extremely robust in 2022. On many submarkets in Europe, strong demand coincides with a short floor space supply. Prime rents for logistics real estate are responding with steady upward growth. The trend is fuelled not least by substantial increases in financing and construction costs. During the second half of 2022, yield rates almost everywhere in Europe showed signs of decompression, although the yield dynamic differed drastically from one country and region to the next.

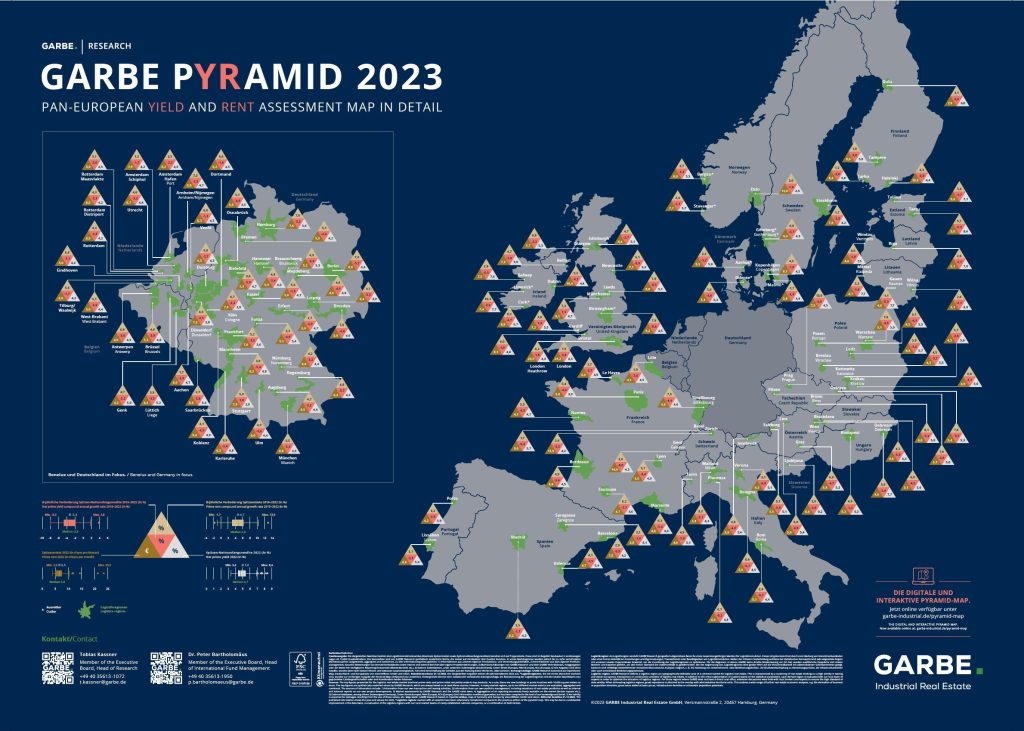

These are some of the findings that GARBE Research presented in its latest GARBE PYRAMID MAP, the 2022 year-end update of the company’s overview of prime rents and prime net initial yields for the 122 most important logistics real estate submarkets in 23 European countries.

Particularly swift rental growth during the second half of 2022 was recorded in submarkets in the United Kingdom and in Ireland. London (+3.00 euros/sqm) and Birmingham (+0.70 euros/sqm) topped the list here. A broad range of submarkets between Munich and Warsaw also manifested a brisk growth dynamic. Particularly noteworthy here are Prague (+1.40 euros/sqm), Munich and Brno (+0.80 euros/sqm each). The Nordic capitals of Oslo and Helsinki also made significant gains (+0.70 euros/sqm each). Overall, rent increases on the logistics real estate markets of Europe approximated +0.40 euros/sqm on average.

Tobias Kassner, Head of Research at GARBE Industrial Real Estate GmbH, explained: “The keen demand for space illustrates the stability of the occupier market. That being said, the land shortage and the decline in construction activities prompted by construction and financing cost hikes has a limiting effect. The rental growth dynamic will therefore maintain its pace for the time being.”

The upward trend in prime rents, which has been sustained for years now, continued on the German market just like elsewhere during the second half of 2022. The markets with the strongest dynamic, aside from Munich, were other Class A cities, such as Hamburg, Düsseldorf and Stuttgart (+0.60 euros/sqm). Similar rent hikes for prime assets were also registered in secondary markets like Duisburg, Koblenz and Regensburg. Still, the highest prime rents were paid in the “Big Seven” or Class A cities. Rates here range from 7.00 euros/sqm in Cologne to 9.00 euros/sqm in Munich.

Kassner commented the fact: “The lack of land development potential and of human resources in Germany’s leading logistics regions has increasingly forced occupiers to settle for alternatives in secondary markets and locations. The growing acceptance of such sites is reflected not least in the dynamics of the local rental growth. Cases in point are the cities of Dortmund, Duisburg and Dresden with average annual growth rates of up to ten percent over the past five years.”

The decline in net take-up toward year-end in some German logistics regions is in most cases explained by the fact that vacancy rates are at an all-time low, the market being virtually swept clean of units to let. On top of that, the muted economic sentiment has also caused a number of signings to be postponed.

Kassner went on to say: “To a large extent, the e-commerce sector ceased to act as driver of the demand for space in 2022. We assume that businesses in this segment will step up their level of activities again in the course of 2023 or in 2024 at the latest – and that this will have corresponding downstream effects for the space demand. But demand will only be able to maintain its peak level if ways are found to expand the floor space supply by zoning more land for development.”

European Investment Market

The parameters on the European financing market underwent a fundamental shift in the course of 2022. While the first half of the year was buoyed by previously planned transactions, the market action cooled off noticeably after the summer break. Prime net initial yields began to soften visibly during the second half of 2022 as a result. At the same time, the dynamic within Europe is far from homogeneous. Compared to the first half of 2022, net initial yields in top markets like Vienna, Rotterdam and Stockholm rose by 70 basis points, as the figures of GARBE show. Elsewhere, yield increases were much more modest at ten to 20 basis points, such as on the secondary markets of eastern Europe (e. g. Ljubljana, Debrecen) whose yields are on a high level anyway.

But despite the fast rise in yield rates seen lately, the average figures for the past five years reveal yield compression in virtually all of Europe’s logistics regions. In fact, yields remain below four percent in Germany’s seven top markets as well as in Leipzig and Paris.

Meanwhile, the momentum of the German investment market for logistics real estate appears to be slowing down: Depending on the region, prime net initial yields rose between 30 and 40 basis points, averaging 3.4 percent in Berlin, 3.5 percent in Munich, and 3.6 percent each in Hamburg and Frankfurt.

Outlook

Energy prices and inflation rate are levelling out at the moment. The economic trend and the consumer climate are following a positive trend. Overall, GARBE expects the situation to start easing by mid-year 2023. The investment market will then be able to get back up to speed while demand for floor space will gain further momentum.

For more figures and methodological details, please see the interactive GARBE PYRAMID MAP. The data referenced in our press release are sourced from the PYRAMID project.

GARBE PYRAMID: Most drastic changes in prime rents and prime net initial yields

| Top 10 – highest prime rents in Europe | |||

| Country | Region/city | 2022 | CAGR 2018–2022 |

| United Kingdom | London-Heathrow | 23.50 | 6.20 |

| United Kingdom | London | 21.20 | 7.50 |

| Switzerland | Geneva | 14.40 | 2.00 |

| Norway | Oslo | 11.80 | 3.00 |

| Switzerland | Zurich | 11.50 | 2.60 |

| Ireland | Dublin | 10.40 | 5.20 |

| Finland | Helsinki | 10.30 | 4.30 |

| United Kingdom | Birmingham | 9.20 | 7.90 |

| United Kingdom | Bristol | 9.10 | 6.00 |

| United Kingdom | Manchester | 9.10 | 7.20 |

Source: GARBE Research

| Top 10 – top markets with the lowest prime net initial yields in Europe | |||

| Country | Region/city | 2022 | CAGR 2018–2022 |

| Germany | Berlin | 3.40 | -5.70 |

| Germany | Munich | 3.50 | -3.30 |

| Germany | Frankfurt | 3.60 | -3.20 |

| Germany | Hamburg | 3.60 | -3.20 |

| Germany | Düsseldorf | 3.80 | -2.50 |

| Germany | Stuttgart | 3.90 | -1.80 |

| Germany | Cologne | 3.90 | -2.40 |

| Germany | Leipzig | 3.90 | -3.50 |

| France | Paris | 3.90 | -4.00 |

| France | Lyon | 4.00 | -3.40 |

Source: GARBE Research