GARBE PYRAMID-MAP: Logistics Yields Have Almost bottomed out, Rental Growth Continues at Lower Dynamic

News 30/08/2023

- Sustained pressure on prime rents, but slower pace, at mid-year 2023

- Driving factors include high construction costs and increased financing costs as well as the reduced availability of rental units

- Significant decompression of prime net initial yields is losing momentum, and now continues at a clearly more moderate rate in many logistics regions

- Attractive investment opportunities will incrementally open up toward year-end

Hamburg, 30 August 2023. The investment market remained in its shock-frozen state during the first half of 2023 after the inflation rate and subsequent interest rate adjustments had significantly altered the parameters for the real estate industry within a very short period of time. However, the logistics real estate market is evidently finding a stable basis and emerging from its decompression cycle. A look at many markets shows that the strongest price corrections already took place in late 2022, with the dynamic slowing during the first two quarters. This means that the long-anticipated price stability that investors need could be achieved by the third or fourth quarter. Assuming the interest rate development is stable, investors could come out of limbo and the investment market regain momentum on a modest level.

During the same time period, the logistics take-up declined as well. This is to some extent attributable to the economic situation. But it also suggests that (new-build) rental units are in short supply. In most logistics regions, demand for space still exceeds the available supply in plots of land and rental units by far. As a result of the persistently high demand pressure, prime rents kept soaring during the first quarter before the growth dynamic slowed during the second quarter.

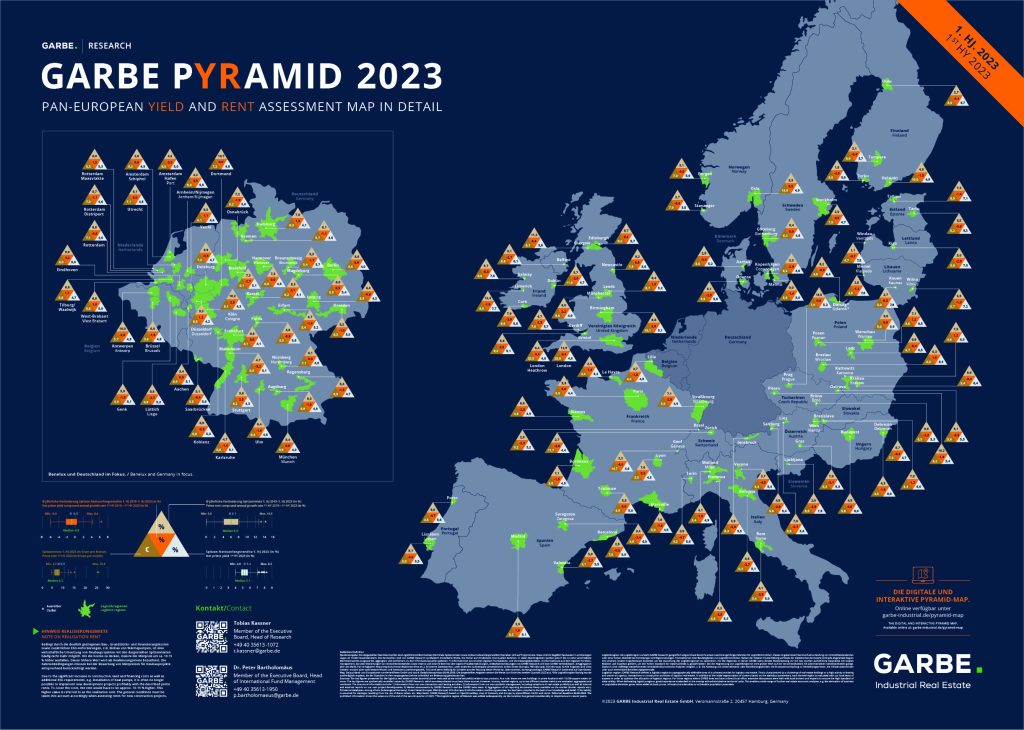

These are the findings that GARBE Research presented in its latest GARBE PYRAMID MAP, the 2023 mid-year update of the company’s overview of prime rents and prime net initial yields for the 123 most important logistics real estate submarkets in 23 European countries.

Specifically, rent increases registered in the course of the first half-year were particularly brisk in the sub-markets of the United Kingdom, most notably in London (+4.60 euros/sqm), London-Heathrow (+2.00 euros/sqm) and Glasgow (+1.00 euros/sqm). In a Europe-wide synopsis, several submarkets in western Germany stood out with high growth rates, especially Cologne (+1.10 euros/sqm), Dortmund (+1.00 euros/sqm) and Düsseldorf (+0.80 euros/sqm), as did Munich (+0.80 euros/sqm). Overall, rent increases on the logistics real estate markets of Europe approximated +0.44 euros/sqm on average.

Tobias Kassner, Head of Research at GARBE Industrial Real Estate GmbH, explained: “Demand for logistics floor space has so far been immune to the shifted general parameters. The decline in take-up in some German logistics regions at the start to the year is in most cases explained by the historically low vacancy rates, with virtually no available units left on the market. Another contributing factor is the muted economic sentiment.”

As far as the German logistics real estate market goes, it is safe to say that the growth in prime rents, which has been ongoing for years, continued nationwide during the first half of 2023. By comparison, prices in many other European markets have lately followed a less dynamic trend. Here, growth rates are levelling out.

The markets with the strongest dynamic in Germany, aside from the already mentioned submarkets in the west of Germany and Munich, are primarily secondary markets, including Bielefeld and Duisburg (+0.80 euros/sqm each) but also Hanover and Osnabrück as well as the prime location of Hamburg (+0.70 euros/sqm each). Lately, the highest prime rents have been paid in the “Big Seven” or Class A cities. They range from 8.00 euros/sqm in Düsseldorf to 9.80 euros/sqm in Munich.

Adrian Zellner, Head of Business Development at GARBE, commented: “In many logistics regions, the scant land development potential remains an acute issue. It is exacerbated by the fast-paced construction price development of the past year and a half. As a result of these two factors, we have seen enormous rental growth in regions beyond the ‘Big 7 cities’ that retain land development potential over the past two years. Such regions include most notably the Ruhr, Eastern Westphalia-Lippe/Osnabrück and Kassel. Due to this situation and to human resource issues, locations outside the conurbations are increasingly accepted by the market. Among these are areas in northern Bavaria, the A4 motorway axis and the Berlin-Leipzig-Magdeburg triangle above all.”

Kassner added: “To a large extent, e-commerce ceased to act as space demand driver in 2022. We assume that businesses in this segment will step up their level of activities again in the course of 2023 or in 2024 at the latest – and that this will have corresponding downstream effects for space demand. Since the dynamic in new-build construction is generally declining, the pressure to find space will increase, and rising rent rates will be part of the ‘new normal’ on the logistics real estate market.”

European Investment Market

Players on the European investment market for logistics real estate have proceeded with the utmost caution during the first half-year. Compared to the prior-year period, the transaction volume decreased by nearly two thirds. As a result, prime net initial yields continued to soften noticeably during the first half of 2023. The increase was most pronounced during the first quarter, when yield rates went up by 30 basis points on average. The dynamic during the second quarter was significantly slower with an average of 10 basis points. That said, the dynamic varies considerably across Europe.

On the one hand, prime net initial yields in markets like Rotterdam-Maasvlakte and Arnhem / Nijmegen gained 80 basis points since year-end 2022. In some of the eastern European capitals (Warsaw, Vilnius, Prague), the yield growth amounted to 70 basis points. Significant increases by 60 basis points were reported from certain submarkets in Poland, Germany and the Netherlands.

On the other hand, there were many logistics regions with comparatively moderate decompression rates or indeed with a stable trend. This is mainly true for markets that already experienced yield compression before the end of 2022. These include secondary markets in the UK, the Nordics, Austria and Italy (e. g. Bristol, Leeds, Bergen, Innsbruck, Turin) above all but also selected capitals (Oslo, Stockholm). Some of them represent secondary and tertiary cities where the already very high yield level prevented any further decompression (e. g. Ljubljana, Galway, Debrecen). The pressure to adjust yield rates was therefore lower in these cities.

The most expensive markets are still found in Germany. The country is also characterised by a slower dynamic: Depending on the region, prime net initial yields increased by 30 to 60 basis points, ranging from 4.0 percent (Berlin, Munich) to 5.9 percent (Saarbrücken). In general, yields below four percent were no longer achieved anywhere in Europe by mid-year.

Outlook:

The degree of uncertainty in the real estate investment market above all, but also in the macroeconomic context, remains a major factor. However, the efforts to contain inflation are proving effective, causing the trend in interest rates to level out gradually. There is mounting evidence that yield rates are back on a stable basis. GARBE therefore expects to see the strain on markets ease by the end of the year, assuming that current trends continue. Demand for space has remained robust in 2023, yet the total net absorption by year-end will be significantly lower than the comparables of prior years. Given the fact that construction activities are decreasing while vacancy rates remain low, pent-up demand is here to stay, so that prime rents will keep going up – albeit at a more moderate pace than in previous years.

For more figures and methodological details, please see the interactive GARBE PYRAMID MAP (https://www.garbe-industrial.de/research/pyramid-map/). The data referenced in our press release are sourced from the PYRAMID project.

GARBE PYRAMID: Most drastic changes in

prime rents and prime net initial yields

| Top 10 – highest prime rents in Europe | |||

| Country | Region/city | Q2 2023

(in euros) |

CAGR* Q2 2019 – Q2 2023 (in %) |

| United Kingdom | London | 25.80 | 12.9 |

| United Kingdom | London-Heathrow | 25.50 | 8.4 |

| Switzerland | Geneva | 14.70 | 2.2 |

| Norway | Oslo | 13.00 | 5.5 |

| Switzerland | Zurich | 11.70 | 2.7 |

| Ireland | Dublin | 11.00 | 5.7 |

| Finland | Helsinki | 10.60 | 4.8 |

| United Kingdom | Birmingham | 10.10 | 5.1 |

| Germany | Munich | 9.80 | 8.4 |

| United Kingdom | Manchester | 9.80 | 8.0 |

Source: GARBE Research

*CAGR = Compound Annual Growth Rate

| Top 10 –markets with the lowest prime net initial yields in Europe | |||

| Country | Region/city | Q2 2023 (in %) | CAGR* Q2 2019 – Q2 2023 (in %) |

| Germany | Munich | 4.00 | 0.6 |

| Germany | Berlin | 4.00 | 0.0 |

| Germany | Hamburg | 4.10 | 1.3 |

| Germany | Frankfurt | 4.10 | 0.6 |

| Germany | Düsseldorf | 4.20 | 1.2 |

| Germany | Stuttgart | 4.30 | 2.5 |

| Germany | Cologne | 4.30 | 2.5 |

| Germany | Leipzig | 4.30 | -0.6 |

| Switzerland | Zurich | 4.40 | -5.0 |

| France | Paris | 4.40 | 0.0 |

Source: GARBE Research

*CAGR = Compound Annual Growth Rate