GARBE PYRAMID-MAP: Investment Market for Logistics Real Estate Suggesting Positive Outlook for 2024

News 01/02/2024

- Yield decompression close to peaking

- Growth in top rents for prime logistics assets continued on moderate level during second half of 2023

- Shortage in available units and persistently high implementation costs remain driving factors

- Investment market gathered momentum during second half-year, with increase in transactions expected in 2024

Hamburg, 1 February 2024. Logistics real estate managed to stand its ground in 2023, emerging as one of the most attractive segments despite its modest investment volume. The initial signs of a positive dynamic seen during the second half-year have kindled hopes that the investment market will revive and open up interesting opportunities. The increase in key lending rates has proven an effective countermeasure, bringing the inflation down faster than expected. Many market analysts now predict a decline in interest rates and therefore a drop in financing costs by mid-year 2024, with corresponding downstream effects on yield rates, which had experienced significant decompression over the past years. “The pricing phase on the investment market for logistics real estate is gradually drawing to a close. In 2024, attractive market opportunities will emerge and mark the onset of the next investment cycle,” said Tobias Kassner, Head of Research and Member of the Executive Board at GARBE.

By contrast, the rental market is slow to transition to the new market cycle and is retarding the rent performance, which has been dynamic so far, in a variety of ways, depending on the regional availability of space and the local economic development.

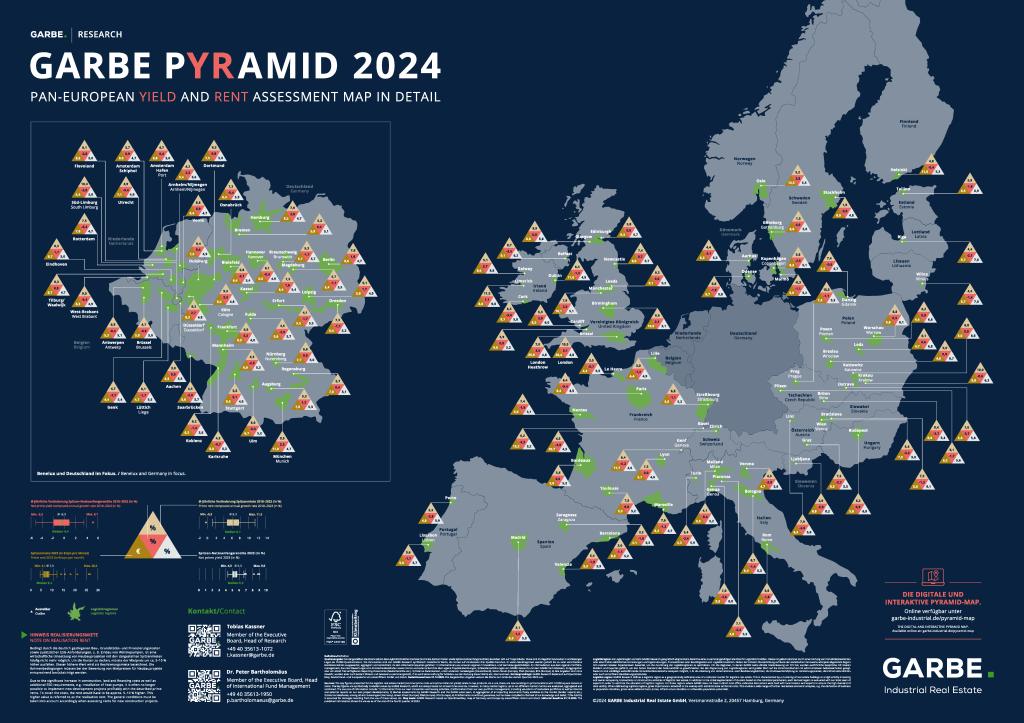

These are the findings that GARBE Research presented in its GARBE PYRAMID MAP for early 2024, the latest update of the company’s overview of prime rents and prime net initial yields for the 112 leading logistics real estate sub-markets in 23 European countries.

European Investment Market

In response to the drastically changed geopolitical and finance policy parameters of the past two years, operators on the European investment market for logistics real estate showed noticeably more restraint in 2023 than they had in previous years. During the first nine months of the year, the transaction volume took a nosedive, declining by around 58 percent over prior-year period. Other asset classes presented

a similar picture. Investments in office real estate, for instance, dropped by more than 60 percent across Europe.

But after bottoming out during the first quarter, the transaction volume recovered successively. Softening real estate prices and the prospect of an end to key lending rate hikes have encouraged a first group of investors—notably equity-rich players— to exploit the opportunities that market corrections presented in recent months. However, the transaction volume was well below the level of previous years.

Dr Peter Bartholomäus, Head of Fund Management & Capital Markets, Member of the Executive Board at GARBE, elaborated: “In the eyes of investors, logistics real estate stood its ground as an asset class in 2023. With its low vacancy rates, demand still strong in many regions when compared to available supply, and the prospect of further potential for rent growth, it clearly outperformed office and retail real estate, for instance. In fact, in some European markets, such as Germany or Italy, logistics investments have lately claimed the largest share of the overall investment market.”

A look at the past eighteen months reveals a slowing decompression dynamic. With a gain of 50 basis points, the fastest increase in yield rates was registered during the second half of 2022. In the course of 2023, prime yields went up by roughly another 55 basis points, with the rate of increase higher during the year’s first half (+35 bps) than during its second half (+20 bps).

In top markets like the United Kingdom and the Netherlands, the average rise in prime yields was down to seven and ten basis points, respectively, during H2 2023. Indeed, prime yields in some eastern European markets, including the Baltics and Slovakia, but also in Switzerland, saw no change at all. Such trends usually herald the onset of the next cycle, and this is particularly true for the British market. Seen in the context of a prospective reduction in key lending rates by summer of 2024, this suggests that we are gradually nearing the decompression peak.

At the end of 2023, the priciest markets were located in Germany, the Netherlands, France and Switzerland. Topping the list was the Zurich logistics region with a prime net initial yield rate of 4.3 percent. Next came Paris (4.5 percent), Geneva and Lyon (both 4.6 percent). In German and Dutch top markets such as Berlin, Hamburg, Munich, Amsterdam and Rotterdam, prime yields are currently at 4.7 percent. In some markets, prime yields for logistics real estate actually undercut those for office real estate.

Germany’s Investment Market

The investment market for logistics real estate in Germany was defined by an average decompression of 35 basis points during the second half of 2023. The transaction volume in this market grew rapidly as the year progressed. After approximately 2.4 billion euros worth of transactions had been closed by mid-year 2023, the pace picked up visibly during the second half of the year. The market data released by major estate agencies put the investment volume of the third quarter alone at nearly 1.9 billion euros on average, and that of the fourth quarter at over 2.5 billion euros.

Philipp Loth, Head of Investment Management Germany and Member of the Executive Board at GARBE, elaborated: “The third-quarter total is attributable mainly to larger-scale portfolio deals. In the fourth quarter, by contrast, we also noticed an increase in the number of single transactions. In any case, the drop in investment volume in Germany’s logistics segment was much less drastic at 46 percent than the 69-percent drop for office real estate and the 56-percent drop for retail real estate.”

European Occupier Market

The occupier market, too, is showing signs of a gradual stabilisation. As a result of the sluggish economy in the European Union and due to slow global demand, companies remained on the fence during the first half of the year. But during the third quarter, take-up experienced a significant surge, exceeding the Q2 total by 20 percent. It admittedly failed to match the record levels of the two preceding years. Still, demand has normalised and is now on a level with pre-pandemic times.

The cross-European vacancy rate went up to 5.2 percent in the course of the year as a result of flagging demand. But since building activities—especially the construction of speculative schemes—are clearly in decline, vacancies cannot be expected to keep increasing at the same brisk pace.

The normalisation of the demand for space has also impacted rental growth. While prime rents still increased by 6.8 percent during the second half of 2022 and by 6.5 percent during the first half of 2023, the growth slowed to a mere 3.1 percent or 0.22 euros/sqm during the second half of 2023.

A drilldown by country and region reveals stark differences in dynamic though. Above-average increases were registered in the Netherlands (+6.6 percent) and Austria (+4.7 percent). This contrasts with the situation in other markets like the Czech Republic or Denmark, which reported a stable trend.

Outside Germany, the logistics regions seeing the fastest rent growth during the second half-year were mainly located in the Netherlands: Tilburg/Waalwijk (+15.5 percent), West Brabant (+12.5 percent), Rotterdam (+11.3 percent) and Amsterdam/Schiphol (+8.4 percent). Another region with significant rent growth (8.5 percent) was the Paris metro area. On the whole, the average prime rent in Europe increased by almost 2.00 euros/sqm up to 7,35 euros/sqm (+36 percent) over the past five years.

Germany’s Occupier Market

In Germany, like elsewhere, the absorption of logistics space has normalised after the bumper years of 2021 and 2022, its current average matching the pre-pandemic level. Against the background of recent economic and geopolitical challenges, the take-up has been comparatively stable, even if some companies are postponing planned floor space expansions until the parameters have stabilised. The year-end total of 2023 trailed the ten-year average, which also included the banner years of 2021 and 2022, by about 10% only.

Adrian Zellner, Head of Business Development and Member of the Executive Board at GARBE, explained: “Main influencing factors for the normalised take-up include a decline in the number of property developments due to construction and financing cost hikes as well as the persistent shortage of space in core locations. Moreover, occupiers have been more reticent about renting units in inter-regional locations. This is due to longer lines of communication and hesitant investment decisions on the part of clients, which in turn are attributable to the ongoing recession. Another fact impacting the statistics is the increase in lease renewals.” Zellner added: “Compared to recent boom years, e-commerce lost in significance as a demand driver in 2023. In some instances, units that had been hired during the Covid years were put back on the market by subletting them. Coveted locations continue to see strong demand from industrial and manufacturing companies: The automotive sector alone accounted for four out of five large-scale lettings, including in two GARBE logistics centres, one located in Bitterfeld-Wolfen in Saxony-Anhalt, the other in Pilsting in Lower Bavaria.”

The rent performance within Germany also differed in its dynamics during the second half-year. Especially in keenly sought-after hot spots with a limited supply of available floor space, prime rents continued to grow briskly, e. g. in Munich (+12.2 percent) and Nuremberg (+8.5 percent). But in several regions, the normalising demand for space has also prompted a stable growth in prime rents. For example, they remained unchanged in Hanover and Leipzig.

The logistics region of Munich is still by far the most expensive location in Germany with a prime rent of 11.00 euros/sqm. Next in line are the other six Class A cities, whose prime rents range from 8.30 to 8.60 euros/sqm and beyond.

Outlook

Tobias Kassner, Head of Research and Member of the Executive Board at GARBE Industrial Real Estate, summarised: “The investment market has picked up a little steam, having lingered on a low level during the second half of 2023. Its robust metrics make logistics real estate a more attractive and safer asset class for many investors than office real estate. This is true for core assets as much as for valueadd properties. Given the prospect of interest rate cuts by summer of 2024, as announced by ECB President Christine Lagarde, there is a good chance that financing costs may come down during the second half of the year.”

Until then, it is safe to assume that prime yields will continue to decompress slightly or remain largely unchanged, depending on how the market cycle progresses. The gradual recovery of the investment market, which already started in the second half of 2023, will continue in 2024. Equity-rich developers and asset managers who have performed well in recent years stand to benefit from this market phase, because the devaluation of the market and possible fire sales could create nice opportunities.

The coming years are expected to see a stable or moderately growing demand for space, with e-commerce (including social commerce) likely to play a bigger role again by 2025, at the latest. In addition, the shortage of land, the scant supply in space to let, and low vacancy rates as well as indexation clauses will ensure further rent growth, most notably in Germany’s Big 7 cities.

Kassner went on to elaborate: “Elsewhere, we are inclined to expect stabilisation. If the inflation continues to subside, it will have a positive effect on consumption patterns and the export of goods in Europe.”

For more figures and methodological details, please see the interactive GARBE PYRAMID MAP . The data referenced in our press release are sourced from the PYRAMID project.

GARBE PYRAMID: Most drastic changes in prime rents and prime net initial yields

| Top 10 – highest prime rents in Europe | |||

| Country | Region/city | Q4 2023

(in euros) |

CAGR*

2018–2023 (in %) |

| United Kingdom | London | 26.40 | 10.5 |

| United Kingdom | London-Heathrow | 25.90 | 7.0 |

| Switzerland | Zurich | 20.70 | 4.5 |

| Switzerland | Geneva | 17.70 | 6.4 |

| Switzerland | Basel | 15.20 | 5.2 |

| Norway | Oslo | 13.50 | 5.2 |

| Ireland | Dublin | 11.60 | 6.4 |

| Finland | Helsinki | 11.00 | 4.8 |

| Germany | Munich | 11.00 | 9.5 |

| United Kingdom | Birmingham | 10.90 | 9.9 |

Source: GARBE Research

*CAGR = Compound Annual Growth Rate

| Top 10 –markets with the lowest prime net initial yields in Europe | |||

| Country | Region/city | Q4 2023

(in euros) |

CAGR*

2018–2023 (in %) |

| Switzerland | Zurich | 4.3 | -4.8 |

| France | Paris | 4.5 | -0.4 |

| France | Lyon | 4.6 | 0.0 |

| Switzerland | Geneva | 4.6 | -5.2 |

| France | Marseille | 4.7 | -1.2 |

| Germany | Berlin | 4.7 | 1.8 |

| Germany | Hamburg | 4.7 | 2.8 |

| Germany | Munich | 4.7 | 3.3 |

| Netherlands | Amsterdam / Schiphol | 4.7 | 0.9 |

| Netherlands | Rotterdam | 4.7 | -0.4 |

Source: GARBE Research

*CAGR = Compound Annual Growth Rate