GARBE PYRAMID-MAP: Europe’s Logistics Real Estate Investment Markets Indicate Trend Reversal

News 30/01/2025

- Average prime net initial yield declining for first time since second quarter of 2022

- Investors interested specifically in Benelux, Spain and Eastern Europe

- Stable or hardening yields in 111 out of 121 European logistics regions

- Forecast by GARBE and Oxford Economics predicts continued decline in prime yields

Hamburg, 30 January 2025. The European logistics real estate investment market appears to be recovering: For the first time since the second quarter of 2022, the average prime net initial yield rates are in decline. Growing investor interest has been reported specifically from the Benelux countries, Spain and some eastern European markets such as Poland and Romania. Here, the drop in prime net initial yields is most readily apparent. That said, the European average fell only by a moderate four basis points from 5.65 to 5.61 percent.

Tobias Kassner, Head of Market Intelligence and Sustainability at GARBE, said: “Our data suggest an incipient trend reversal on Europe’s logistics investment market. Nonetheless, investors will continue to act cautiously because of the geopolitical and economic uncertainties.” He added that demand for assets in good locations let on long-term leases would remain just as strong in future as it is now. “In addition, ESG criteria and the easy availability of electricity still have the highest priority when making investment decisions,” Kassner elaborated.

These are some of the findings GARBE Research released in its latest GARBE PYRAMID MAP for the second half of 2024. The GARBE PYRAMID Map provides a comprehensive overview of prime rents and prime net initial yields in Europe’s 121 most important submarkets for logistics real estate in 25 countries.

Yields Stable or Softening in 111 Logistics Regions

In around 38 percent of the examined logistics regions (46 out of 121), the net initial yield rates fell by ten to 20 basis points during the second half of 2024. In more than half of all logistics regions (54 percent or 65 regions), the yield level remained unchanged. Only ten logistics regions, including seven in Germany, registered a further, albeit modest, increase in net initial yield rates.

Tobias Kassner elaborated: “Investors have regained their faith in logistics real estate investments – not least because the pricing phase is more or less concluded, with price levels having stabilised. In sync with the drop in key lending rates, this has led to a year-on-year increase in European investment volumes in 2024. However, the persistent geopolitical jitters continue to have a muting effect on the market action.”

Established Markets Stable; Some Submarkets Showing Dynamic Trend

Established markets like Germany, Italy, France and the United Kingdom follow a stable trend, with only minimal changes in yield level. Elsewhere in Europe, the development is more dynamic: Spain reported a noticeable hardening of prime net initial yields in its key regions of Madrid, Barcelona and Valencia. A similar development commenced in the Dutch top markets of Rotterdam, Eindhoven, Tilburg and West Brabant.

Several Eastern European markets with a generally high yield level experienced drops by up to 20 basis points, such as in Warsaw, Gdansk and Bucharest. However, the compression during the second half of 2024 was limited to ten basis points in most cases. Other markets remained stable, especially those with an already low yield level like the Czech Republic and Slovakia.

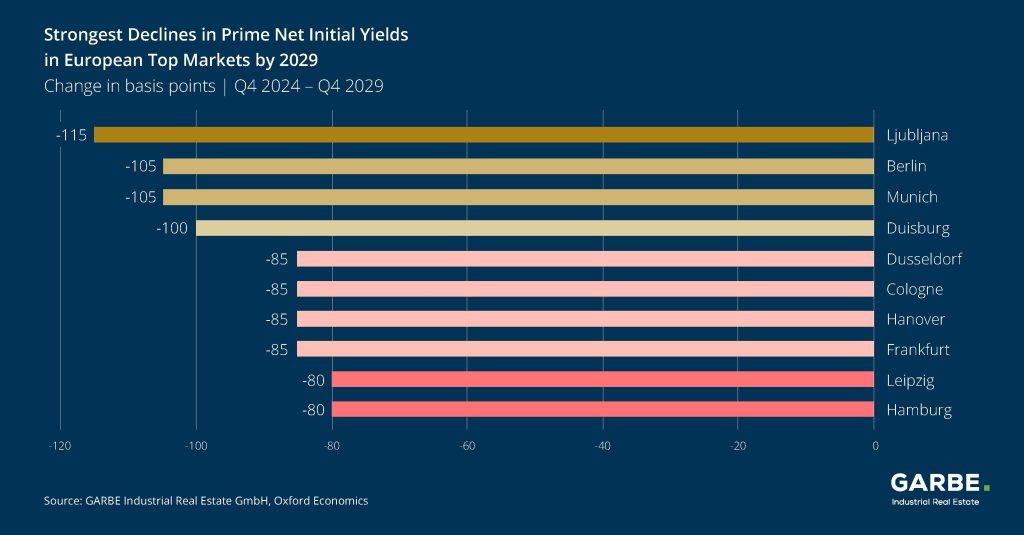

Forecast by GARBE and Oxford Economics: Prime Yields to Keep Hardening

The forecast concentrates on the prospective development of 30 European top markets over the next five years. It reveals that, on average, prime yields will decline be another 10 to 20 basis points in 2025. This moderate dynamic is set to continue in subsequent years – assuming that the geopolitical and finance policy parameters do not deteriorate any further. Generally speaking, yields will be quickest to harden in Germany, the Netherlands and France. Top markets in Italy, the United Kingdom and the Czech Republic are expected to see a slower dynamic.

“A valid assessment of the status quo is crucial for a correct diagnosis of market opportunities and risks. But only a well-informed forecast will enable you to devise a pinpoint strategy,” as Kassner elaborated.

For more figures and methodological details, please see the interactive GARBE PYRAMID MAP. The data referenced in our press release are sourced from the PYRAMID project.