MIPIM 2024 can be seen as a barometer for the state of the European real estate industry, which remains in the grip of an inflation-induced interest rate rally – even as macroeconomic conditions show signs of improvement. However, no significant impulses can be expected from the first quarter of 2024.

Before the industry turns its “gaze forward” and discusses the “tentative, positive signals” for the rest of 2024, the real estate sector is set for a period of Easter respite.

The egg industry is in full swing at Easter. But how have the macroeconomic trends of the last two to three years been reflected here?

In our GARBE PYRAMID EGGSTRA, we took a look at the European markets. The result of our research is an overview that shows the current market price, the average annual growth rate and the harmonized consumer price index of the individual countries.

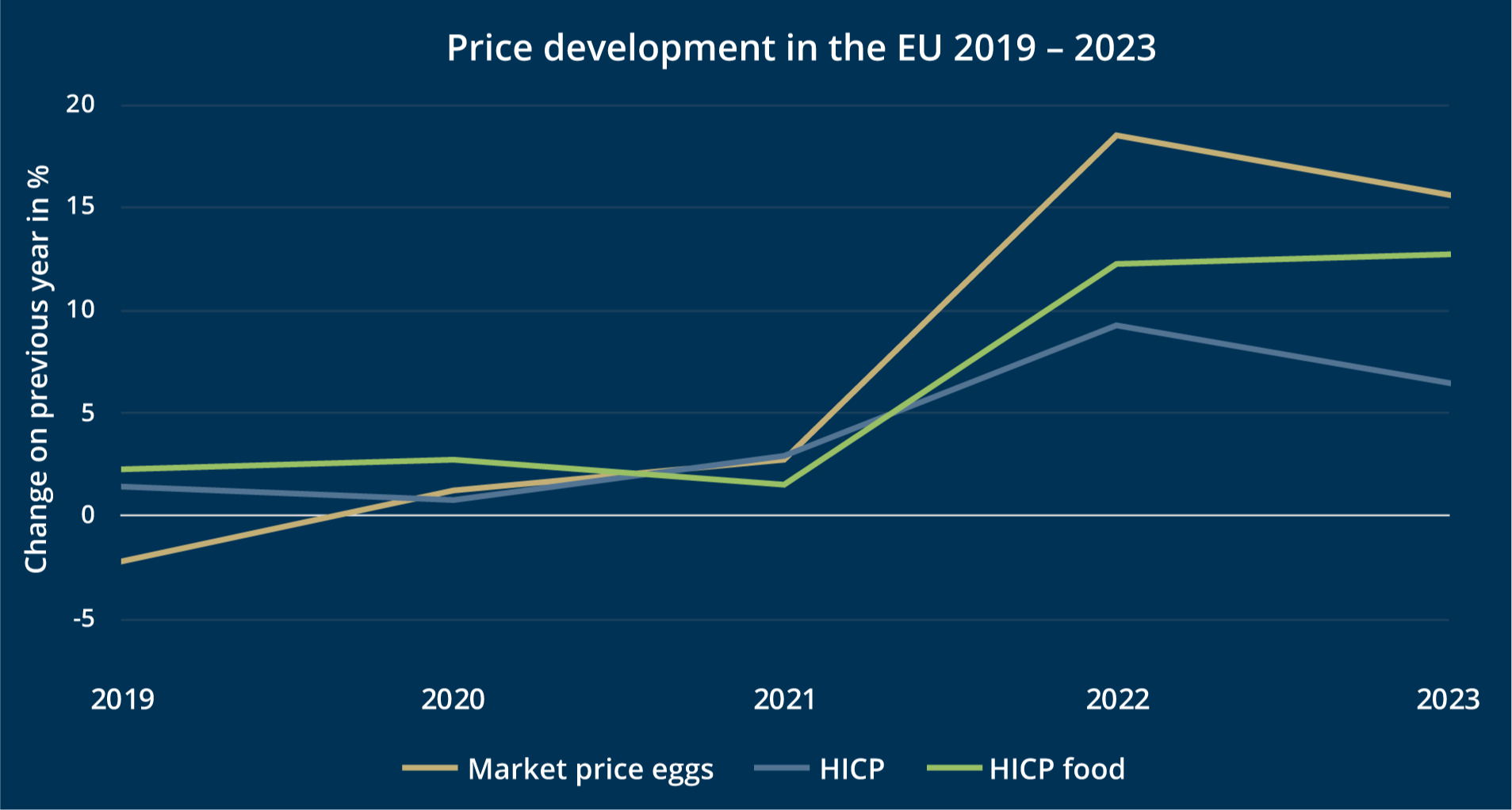

The “egg-flation curve” over the year shows a development similar to that of general inflation. While egg production is not as energy-intensive as the cement, glass, or steel industries, the inflation rate for eggs has risen even more sharply, from about 2.7% in 2021 to a staggering 18.5% in 2022. Although the consumer price index showed a noticeable decrease over the course of 2023, egg inflation only marginally dropped to 15.6%.

Not all aspects of inflation are combatable, especially not with higher interest rates. Looking at egg prices in Europe, there is a wide spread in producer prices. Of the 20 countries examined in our “eggstra study”, eight are above the average price of 1.35 euros per 10-pack. Austria leads with 1.60 euros. Germany also ranks among the more expensive countries at 1.50 euros, along with Sweden, France, Italy, and Poland, and surprisingly, Estonia – despite Lithuania, located at the opposite end of the scale with just 0.99 cents, both being in the Baltics with similar structures.

Germany experiences the highest inflation rate, with a CAGR of over 16% in the last five years, significantly above the EU average of around 12%. Spain and France are also among the countries with the highest price increases.

The egg industry suffers from the same macroeconomic conditions as the real estate sector, and by mid-2022, the effects became tangible for consumers and processors alike due to global avian flu outbreaks – severe in Europe and the USA, skyrocketing feed prices, rising energy costs, increased wages, and the costs of egg cartons. In Germany, the ban on chick culling has also had an impact.

While the real estate industry is occupied with the prospect of improvement, challenges persist in the egg industry. By 2027, cage-keeping is likely to be banned in the EU, necessitating extensive investments.

Therefore, egg prices are not expected to decrease quickly or significantly, and egg inflation is likely to remain high. However, Easter will continue to come in the following years, and the Easter holidays will persist. The Easter Bunny will continue to be busy.

In this spirit, Happy Easter! We wish you lots of fun with our PYRAMID EGGSTRA. If you are interested not only in the egg industry but also in the development of the European logistics property markets, we recommend our PYRAMID MAP.

We use cookies on our site. Some of them are essential, while others help us to improve this website and to show you personalised advertising. You can either accept all or only essential cookies. To find out more, read our privacy policy and cookie policy. If you are under 16 and wish to give consent to optional services, you must ask your legal guardians for permission. We use cookies and other technologies on our website. Some of them are essential, while others help us to improve this website and your experience. Personal data may be processed (e.g. IP addresses), for example for personalized ads and content or ad and content measurement. You can find more information about the use of your data in our privacy policy. You can revoke or adjust your selection at any time under Settings.

If you are under 16 and wish to give consent to optional services, you must ask your legal guardians for permission. We use cookies and other technologies on our website. Some of them are essential, while others help us to improve this website and your experience. Personal data may be processed (e.g. IP addresses), for example for personalized ads and content or ad and content measurement. You can find more information about the use of your data in our privacy policy. This is an overview of all cookies used on this website. You can either accept all categories at once or make a selection of cookies.