GARBE PYRAMID: Eastern European and Italian Logistics Markets Offer Alternative Investment Opportunities

News 04/11/2021

• GARBE Research updates its yield and rent map of European logistics markets as of mid-year 2021

• Germany and Benelux remain firmly established core markets

• More and more secondary markets in Germany are evolving into attractive investment alternatives, including many East German logistics regions such as Magdeburg or Erfurt

• The e-commerce share in Germany shows upside potential and continues to drive the demand for space

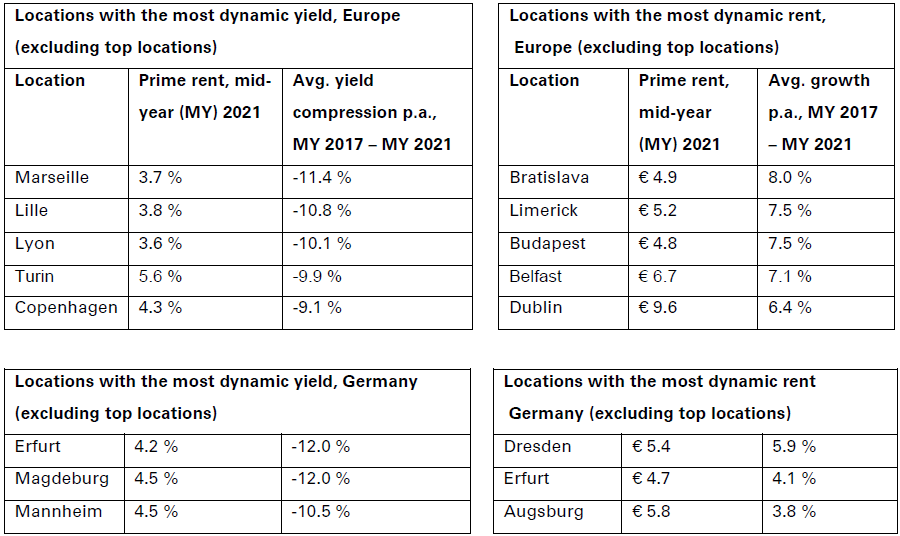

Hamburg, 4 November 2021. GARBE Research just updated its GARBE PYRAMID, a newly developed yield and rent map for the 122 leading European submarkets for logistics real estate whose first edition was introduced by the company in February 2021. The map is updated twice a year to offer current, detailed and succinct information on prime rents and prime yields as well as their change dynamic. Important insights of the latest GARBE PYRAMID include the following: Attractive investment opportunities present themselves especially in Eastern Europe, Italy and the Nordics. These emerging markets showed a fast yield compression of nearly ten percent in the latest PYRAMID. Germany’s logistics real estate market, together with those of the Benelux countries, continue to count among the European core markets. Especially the eastern part of Germany has seen a brisk yield performance with a compression ratio of up to 12 percent.

Secondary Markets Develop Dynamically – E-Commerce Remaining the Main Driver

Jan-Dietrich Hempel, Managing Director of GARBE Industrial Real Estate, elaborates: “The logistics market was one of the few that followed an upward trend during the coronavirus pandemic, not least because logistics served a basic supply role, being an essential industry. It became quite apparent that more regional warehouse and logistics facilities are needed to ensure that production and supply chains function properly. In addition, the e-commerce business actually experienced brisk growth during the pandemic. Online retailing will remain one of the drivers of demand for more logistics facilities. Compared to other countries, Germany’s e-commerce segment still claims a low share of total retail sales. This means that the sector’s need for logistics facilities beyond the classic Big 5 markets will keep growing.” On the subject of yield performance, he had this to say: “Prime net initial yield levels in the top regions are closing in on each other, not least because of demand, especially in Germany. The rising number and growing differentiation of logistics markets does little to change that. Worthwhile alternatives are found mostly in secondary markets. But even here, we have noted yield compression because investment demand just keeps increasing.”

Rent Level Rising – Highest Rents Achieved Outside the Eurozone

The highest prime rents per square metre in Continental Europe are paid outside the single-currency area: The market price in Geneva equals 14.00 euros, ahead of 11.00 euros in Zurich, and 10.70 euros in Oslo. Especially in Switzerland, the price is driven by high wage levels. The only locations inside the eurozone that made the top list are Dublin with 9.60 euros and Helsinki with 9.40 euros per square metre. Logistics rents in the United Kingdom continued to rise during the first half of 2021. The trend was driven by the unchecked growth of the e-commerce sector in combination with the lengthening of supply chains in the wake of Brexit. The coronavirus pandemic has further boosted the development. Suitable facilities are therefore in short supply. Nowhere is this truer than in the international hub of London. Here, the going square metre rent equals 16.00 euros, or indeed 16.20 euros in the Heathrow submarket, the highest rate in Europe. In Germany, the locations with the highest rent levels were still the major hubs, such as Munich with 7.60 euros, Stuttgart with 7.00 euros, Berlin and Frankfurt with 6.70 euros each, and Hamburg with 6.50 euros per square metre.

“As a result of the steadily increasing demand for logistics assets and the shortage in suitable facilities, we keep seeing fast-paced rental growth. Factors explaining the brisk rise in rents also include the now extremely high construction prices and costs of land,” elaborated Tobias Kassner, Head of Research at GARBE Industrial Real Estate. “Both take-up and investment action tell us that secondary markets not just in Germany but across Europe in general are increasingly moving into focus now. The trend creates a lot of attractive investment opportunities in markets like Eastern Europe, Italy and the Nordics. Their growing appeal is reflected in the fast rental growth in these markets.”

Change dynamic outside the core markets in Europe and Germany

For more stats and for details on methodology, please see the GARBE PYRAMID for Europe and Germany.

The data referenced in our press release are sourced from our PYRAMID project. The survey focus here is on geographic breadth, meaning that our goal is to analyse as many markets and submarkets as possible.