The topic of sustainability is one of today’s megatrends, and that goes beyond the real estate sector. Ambitious goals such as the climate neutrality of all existing properties by 2050 are adding fuel to the sustainability discussion. The entry into force of the European Sustainable Finance Disclosure Regulation on 10 March 2021 has given the issue even more relevance – and binding force. It contains regulations regarding environmental, social and corporate governance criteria, in short: ESG. But what is behind ESG and how is it implemented in logistics real estate? Find out more here.

Sustainability is a megatrend not only on the GARBE Impact Map. As one of the most current topics of our time, it extends far beyond just the real estate sector. The issue is once again gaining even more relevance – and binding force – with the European Sustainable Finance Disclosure Regulation entering into force and applying to real estate funds too. The purpose of increasing regulation is to prevent the spread of ‘greenwashing’ by using a diverse range of ‘green labels’ and undefined features based on the disclosure of ESG criteria. It is the first step towards establishing EU taxonomy for sustainable finance, increased transparency in the evaluation of sustainability issues and binding targets. Many details, however, are still unclear. This lack of clarity usually already starts with the vagueness surrounding the definition of sustainability and ESG criteria.

The basic idea behind sustainability is to trim all aspects of the value chain to be sustainable. This initiative is not only restricted to economic sustainability but also incorporates environmental and social aspects. Many driving forces and instruments are now available to give structure to this goal and make it quantifiable.

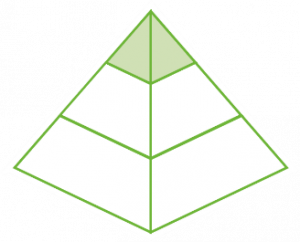

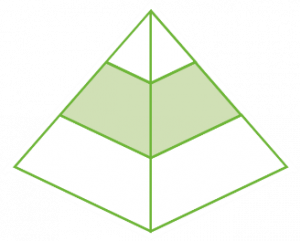

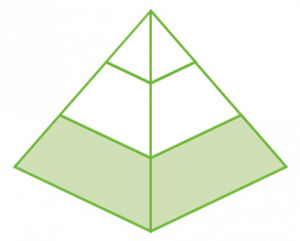

The main drivers of sustainability are Corporate Social Responsibility (CSR) and Environmental, Social, Governance (ESG). CSR is the social commitment of companies to do business sustainably. The voluntary approach towards CSR, however, is said to be too vague and therefore outdated. ESG takes up the idea of CSR and specifies the areas to which responsibility applies: Environmental, Social and Governance. These aspects are progressively gaining in importance, not least due to increasing external regulation, both in EU taxonomy and in the real estate industry. EU taxonomy’s goal is to facilitate the classification of environmentally sustainable economic activities through the use of a ‘green list’. The newly created transparency allows for funds to be channelled purposefully into sustainable investments. A vast array of ESG criteria are also included in this externally specified framework. The following features are examples of the different criteria required in the real estate industry:

The main drivers of sustainability are Corporate Social Responsibility (CSR) and Environmental, Social, Governance (ESG). CSR is the social commitment of companies to do business sustainably. The voluntary approach towards CSR, however, is said to be too vague and therefore outdated. ESG takes up the idea of CSR and specifies the areas to which responsibility applies: Environmental, Social and Governance. These aspects are progressively gaining in importance, not least due to increasing external regulation, both in EU taxonomy and in the real estate industry. EU taxonomy’s goal is to facilitate the classification of environmentally sustainable economic activities through the use of a ‘green list’. The newly created transparency allows for funds to be channelled purposefully into sustainable investments. A vast array of ESG criteria are also included in this externally specified framework. The following features are examples of the different criteria required in the real estate industry:

‘E’ for environmentally sustainable behaviour:

|

|

‘S’ for social responsibility:

|

|

|

‘G’ for good governance:

|

While the call for sustainability was still quiet 20 years ago, the demand for it now can be distinctly heard at all levels of management, in all asset classes and for all properties, not least thanks to increasing regulation. There are various instruments and options available to implement this at the different levels.

While the call for sustainability was still quiet 20 years ago, the demand for it now can be distinctly heard at all levels of management, in all asset classes and for all properties, not least thanks to increasing regulation. There are various instruments and options available to implement this at the different levels.

Creating market transparency in relation to ESG criteria and gradually implementing reporting and benchmarking based on GRESB (Global Real Estate Sustainability Benchmark) are fundamental steps that need to be taken at the real estate funding level. GRESB makes transparent portfolio reporting possible through the establishment of international standards, such as CRREM (Carbon Risk Real Estate Monitor). The standard defines how to calculate carbon emissions to determine carbon reduction pathways based on the Paris climate targets, in order to limit the rise in global temperatures to 2°C or 1.5°C. To compose a portfolio, guiding principles which strive to incorporate all ESG aspects can be defined. Further instruments are promoting diversity and choosing business partners based on exclusion criteria. In this regard, the UN Sustainable Development Goals are regarded as a minimum requirement.

The main focus for the management of assets is on implementing overarching defined measures and targets, which includes complying with the vehicle specifications for portfolio composition and project development as well as expanding due diligence criteria to include ESG aspects. Other areas of activity include consciously selecting business partners based on ESG exclusion criteria, social engagement, and being an employer with a sense of responsibility. Efforts should also be made to use the market position to continue discussions with GRESB to further develop and improve the framework methods.

The main focus for the management of assets is on implementing overarching defined measures and targets, which includes complying with the vehicle specifications for portfolio composition and project development as well as expanding due diligence criteria to include ESG aspects. Other areas of activity include consciously selecting business partners based on ESG exclusion criteria, social engagement, and being an employer with a sense of responsibility. Efforts should also be made to use the market position to continue discussions with GRESB to further develop and improve the framework methods.

The measures and instruments taken in relation to the properties themselves all depend on the type of property. No matter whether core/core plus, value-add or new construction, the ESG guidelines defined for funding must be consistently implemented for all of them in terms of selecting assets and the investment processes. In all cases, continued commitment and constant monitoring is vital to identifying opportunities for optimisation. The evaluation of rental contracts and the implementation of standards (‘green lease’) also contribute to a sustainable property. Compliance with defined standards is also ensured by using any certificates and frameworks in existence (e.g. BREEAM, LEED, DGNB).

Features of sustainable logistics real estate

GARBE is also aware of its environmental, social and economic responsibility and is gradually preparing its funds for reporting according to GRESB. GARBE’s 360-degree approach to management allows all relevant ESG criteria to be covered at the different levels of management. Further information on ESG at GARBE is available here. At the property level, ESG starts off by maintaining that, in many cases, it is more resource-efficient to invest in older existing properties and to continue to operate them instead of always aiming for a new building or demolition/new construction. After all, both renovated and unrenovated buildings have a competitive advantage when it comes to the ‘grey energy’ saved in the construction phase. [Link to ‘It does not always have to be a new construction’] Overall, there are many different tools and options available for applying the ESG concept to existing properties and project developments.

Implementing ESG measures to existing real estate is often harder due to the limited possibilities for making adjustments. In addition to measures to extend the life cycle, possible approaches include environmentally and economically sustainable renovation/additional measures such as smart metering, LED lighting, solar power systems, e-mobility charging stations and green areas. Instruments to realise social criteria also include upgrading bicycle storage infrastructure, outdoor leisure facilities or setting up appealing social environments. These measures can have a marked impact on the life cycle assessment and ESG compatibility with relatively little effort to implement.

Implementing predefined ESG criteria on a larger scale is easier, however, during project development, as specifications can be incorporated directly into planning. The first step is to check whether an existing property can be demolished/rebuilt within a developed commercial area in the conurbation (brownfield) to prevent further sealing of surfaces. In particular, property-specific options, such as the responsible use of materials, etc. through recycling and the use of recyclable building materials according to the cradle-to-cradle principle, the creation of flexible usage concepts or the use of renewable energies (e.g. photovoltaic systems) can be used in the implementation. Other aspects that help to improve a new build’s sustainability include not using impervious surfaces for paving, improving energy efficiency by using optimised insulation on the roof, facade and glass surfaces, and incorporating green areas or green walls and roofs. Social compatibility aspects, such as facade and outdoor area design, public transport connections or social areas, can also be implemented more easily.

It should always be in everyone’s interest to promote sustainability. In the past, however, many players have frequently been deterred from consistently implementing ESG criteria due to the financial costs involved and the lack of implementation strategies available. Increasing external regulation, however, is at least forcing many players on the financial markets to be more transparent when it comes to sustainability. The disclosure obligation is helping to reduce previously unclear ‘greenwashing’, whereas new regulations are also generating new requirements for real estate fund managers. In the future, both tenants and investors will be able to request that proof of relevant sustainability aspects be provided before making decisions about purchase or rental contracts. The effort is all worth it, however. Demand for sustainable real estate has increased substantially within only the last few years. More and more users and investors are keeping an eye out for compliance with sustainability criteria and the existence of environmental certificates for their properties. The demand for sustainable real estate products is likely to rise even further in the future due to ongoing regulation and growing environmental awareness.

We use cookies on our site. Some of them are essential, while others help us to improve this website and to show you personalised advertising. You can either accept all or only essential cookies. To find out more, read our privacy policy and cookie policy. If you are under 16 and wish to give consent to optional services, you must ask your legal guardians for permission. We use cookies and other technologies on our website. Some of them are essential, while others help us to improve this website and your experience. Personal data may be processed (e.g. IP addresses), for example for personalized ads and content or ad and content measurement. You can find more information about the use of your data in our privacy policy. You can revoke or adjust your selection at any time under Settings.

If you are under 16 and wish to give consent to optional services, you must ask your legal guardians for permission. We use cookies and other technologies on our website. Some of them are essential, while others help us to improve this website and your experience. Personal data may be processed (e.g. IP addresses), for example for personalized ads and content or ad and content measurement. You can find more information about the use of your data in our privacy policy. This is an overview of all cookies used on this website. You can either accept all categories at once or make a selection of cookies.