E-commerce has expanded significantly over the past decade, reaching unprecedented levels during the pandemic before slowing in the post-pandemic market. While overall e-commerce growth moderated in recent years, trends like fast fashion and social commerce have gained momentum, requiring agile supply chains and its related logistics footprint. With stronger growth expected to resume soon, it’s important to review the current and future landscape of this rapidly evolving sector.

E-commerce growth paused in recent years but has been accelerating in 2024.The pandemic accelerated ~2-3 years’ worth of e-commerce growth, leading to a temporary pause of growth as consumers reengaged with other purchasing channels and leisure activities once societies reopened. This did not indicate an overall decline in e-commerce for a longer term; sales continued to grow, though at a more moderate pace. Internet sales in the EU-8 (weighted average) in July 2024 have surpassed for the first time levels recorded in any month during the pandemic1. One notable outcome of the pandemic was the faster emergence of new sectors, such as online groceries, and even late-adopter consumers became more comfortable with online shopping. These new purchasing habits and trends are likely here to stay. |

Note: EU-8 total covers UK, DE, FR, NL, PL, ES, IT, SE. Weighted average based on total internet sales in 2023. |

A fast-growing sector is fast fashion, providing affordable clothing that reflects current trends, exemplified by companies like Shein. In a short period, Shein has become Europe’s largest fast fashion online retailer, with online net sales in 2023 double those of the second-largest retailer, H&M2. The overall fast fashion industry has experienced significant growth in recent years and is expected to continue expanding, with a 7.5 % compound annual growth rate (CAGR) forecasted for Europe by 20303. To support this growth, non-European fast fashion retailers are establishing European logistics infrastructures instead of relying solely on air freight. At the same time, public, politics and media criticism is rising around overseas fast fashion retailers offering ultra-low-cost products, due to concerns about sustainability, tax regulations, and working conditions in factories.

Another fast-growing sector is social commerce, which involves the use of social media platforms for direct product or service sales, integrating social interaction with online shopping on platforms like TikTok and Instagram. Sales growth for social commerce in Europe is also expected to be robust, with a forecasted CAGR of 20.1 % from 2024 to 20294.

Both fast fashion and social commerce have led to a faster turnaround of trends, placing a stronger emphasis on the agility of supply chains and logistics real estate, such as positioning products closer to consumers (as seen with Shein’s logistics facilities in Frankfurt and Wroclaw) and/or increasing production in neighbouring European markets. Recent case studies show that countries like Turkey, Tunisia, and Morocco are increasingly targeted as manufacturing hubs by European fashion brands due to their proximity to European markets and shorter lead times. This shift is driven by the fast fashion sector’s need to reduce logistics costs, shorten time-to-market, and support more sustainable practices.

Companies that saw skyrocketing growth during the pandemic have tightened their geographical scope.

Some sectors have entered a more challenging environment in recent years. Quick commerce – offering rapid delivery of small quantities of goods, typically within 10 to 60 minutes using local fulfilment centres or dark stores – is one example. Companies that saw skyrocketing growth during the pandemic have tightened their geographical scope, like Zapp (exiting France and the Netherlands) and Gorillas (exiting Germany, the Netherlands, and the United Kingdom). Scaling operations, achieving profitability, intense competition, and navigating local regulations are some of the key challenges currently limiting growth potential.

After the post-pandemic pause, early signs indicate that sales growth is returning to pre-pandemic levels in course of 2024. Based on a panel of 5 million e-shoppers, total e-commerce value (+11 % y/y) and volume (+19 % y/y) increased in 2024 across ten EU-countries5.

Another variable supporting the view e-commerce is entering an inflection point is by analysing weekly transport vehicle flow around Amazon warehouses in Europe’s three largest e-commerce markets. In 2024, the weekly flow of transport within a 2.5 km radius around Amazon warehouses (51 in total) in the United Kingdom, Germany, and France has bottomed out and begun to gradually increase. This nowcasting data, provided by Kania Advisors, tracks traffic movement around key e-fulfilment centres, is an early indicator that e-commerce activity is on the rise. Increasing traffic flows serve as early indicators, which will ultimately be reflected in official monthly online sales data and at a later stage leasing statistic of logistics space, which can be considered as a lagging statistic.

Note: Based on 19 Amazon logistic assets in Germany

At a country level, Germany showed a relatively stronger increase in traffic flows compared to the United Kingdom and France, despite its currently challenging macroeconomic environment. In general, activity bottomed out at the end of 2023 and the beginning of 2024 (see Figure 2). In recent months, traffic seems marginally higher than pre-COVID. The recent uptick is early sign of “back to trend” growth.

At a retailer level, early signs of accelerating logistics real estate leasing activity are expected in the coming quarters. This is already happening in the United States where Amazon has already re-engaged with higher activity. In Europe, this acceleration has not yet occurred. Amazon and other online retailers leased space ahead of demand (sales) during the pandemic and needed to absorb its existing footprint since the end of the pandemic first. However, growth of online sales of Amazon in Europe is in 2024 advancing at a faster rate than its relative footprint, a trend which was historically more aligned⁶. The gap between sales and footprint growth is at record levels and this is expected to narrow leading to higher logistics space need.

Double-digit sales growth is expected in the coming years.For the eight European markets (EU-8) tracked by Green Street/Oxford Economics/CBRE, the latest e-commerce outlook (published in October 2024) shows that e-commerce revenues are projected to return to double-digit growth during the period from 2025 to 2027. This level of growth is similar to what was seen pre-pandemic, which was considered high. Compared to physical retail, e-commerce sales continue to outpace revenue forecasts, with a compound CAGR of 10.1 % for e-commerce compared to 2.3 % for physical retail from 2024 to 2028 (see Figure 3). |

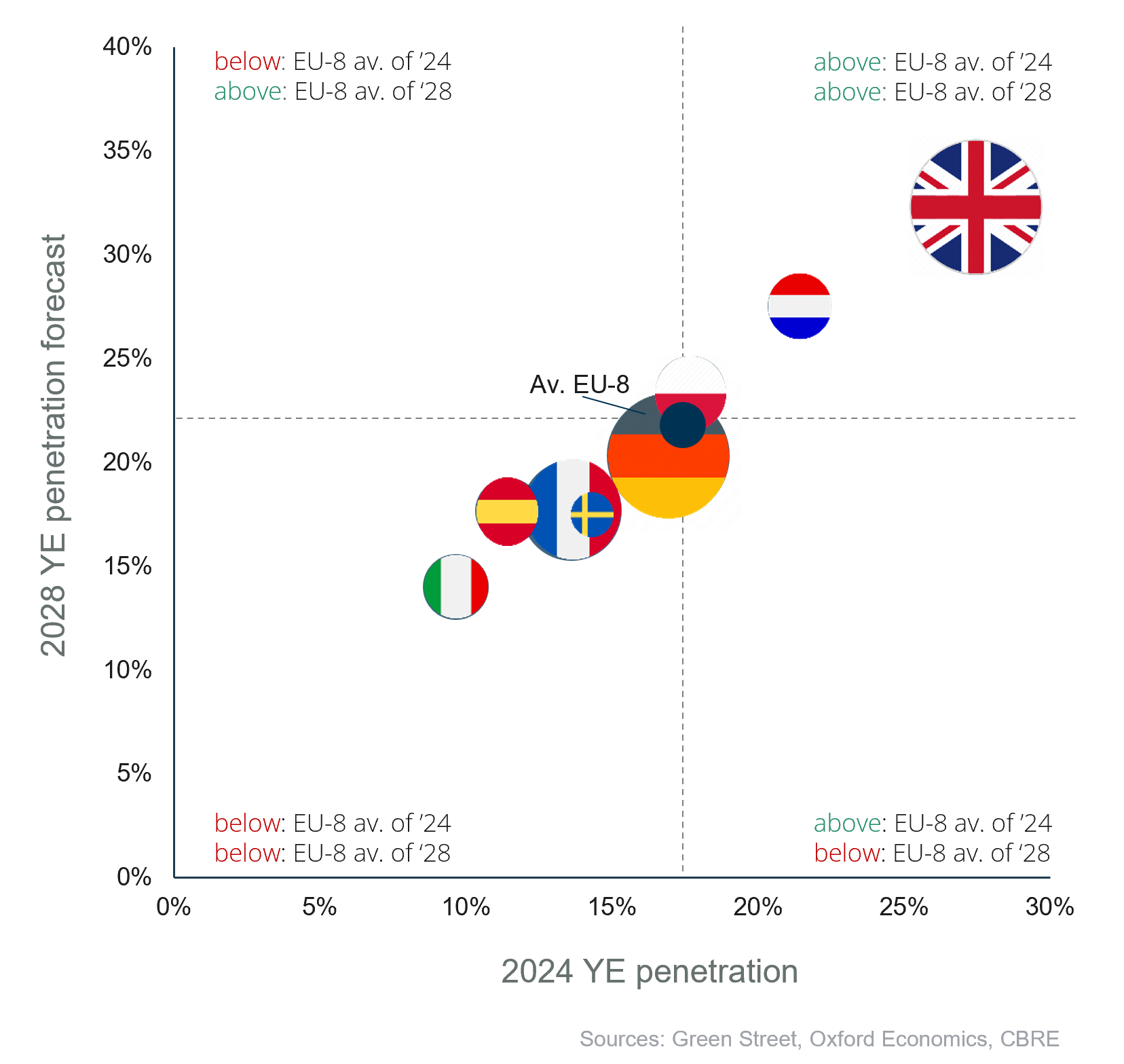

Figure 4: Penetration level in comparison.

Penetration levels have started to rise again since 2022 and are forecasted to reach 17.4 % by the end of this year. This is 10 bps above the level seen during the pandemic at year-end 2020, Over time, penetration is expected to gradually rise to 21.9 % by YE 2028 in EU-86.

Countries like the United Kingdom and the Netherlaands have been, are, and will remain the most advanced in terms of adoption and penetration levels, as shown in Figure 4. The United Kingdom is forecasted to reach a penetration level of 32 % by YE 2028, not only the highest in Europe but also one of the highest in the world6. The top three countries projected to see the strongest increase in penetration from 2024 to 2028 are Poland (+7.1 % to 23.5 %), Spain (+7.1 % to 17.7 %), and the Netherlands (+6.9 % to 27.5 %)6.

E-commerce is forecasted to return to a pre-pandemic growth trajectory, but the mix of expanding sectors is shifting, and consumer habits evolve. This is expected to result in a stronger focus on a decentralized supply chain with smaller real estate satellite hubs near urban concentrations and logistics hotspots. A selection of factors shaping this transition is listed below.

| Cost effectiveness: 50%6 Total supply chain cost in last leg |

The last leg of the e-commerce supply chain can account for 50% or more of total supply chain spending. Moving closer to end consumers saves drivers’ time and wage costs, requires less fuel, and optimizes van usage, despite higher rents for logistics real estate.

|

| Predictability: 90-95 %7 Certainty in goods tracking before warehouse entry |

Customer preferences for flexible and precise delivery times have pushed companies like DHL to leverage AI to predict delivery windows with 90 %-95 % accuracy. With this data, customers receive updates about delivery timing and can make real-time adjustments, resulting in higher satisfaction and fewer missed deliveries. A higher predictability could eventually result in a higher building efficiency and therefore need to be located closer to end customer.

|

| Accuracy: 60%8 Key priority according to last mile delivery retailers in Europe |

In the post-pandemic last-mile environment, retailers consider accuracy a more important success factor than speed, which is ranked second. This can be challenging, as the last-mile delivery market is expected to nearly double during the period from 2022 to 2027.

|

| Carbon footprint: 1.5 to 2.9 times9 More greenhouse gas emissions offline vs. online shopping in Europe |

Offline shopping results in between 1.5 and 2.9 times more greenhouse gas emissions than online shopping. This is driven by more efficient traffic levels (vans vs. individual cars are 4 to 9 times less polluting), lower land use, and reduced building energy consumption.

|

| Fresh products: 33%10 European consumers reported purchasing fresh food online |

This growth trend underscores the need for supply chains and distribution hubs to be located closer to urban areas to ensure the freshness and timely delivery of perishable goods.

|

| Bulkier items: 26%11 European consumers purchasing furniture/home decoration/gardening last 3 months |

The trend toward bulky items emphasizes that a single central distribution point may not be sufficient, as it is not economically feasible to transport larger goods over long distances.

|

After a post-pandemic pause, e-commerce is showing signs of expansion, with indicators suggesting a gradual return to pre-pandemic growth levels.

Fast fashion and social commerce are leading this resurgence, showcasing strong momentum. Nowcasting data, such as increased vehicle traffic near Amazon warehouses and recent increases in monthly online sales, reflect this upward trend. The sector is gradually shifting towards a decentralized logistics model, focusing on urban proximity and logistics hotspots to better meet needs for accuracy, cost-effectiveness, and sustainability.

We use cookies on our site. Some of them are essential, while others help us to improve this website and to show you personalised advertising. You can either accept all or only essential cookies. To find out more, read our privacy policy and cookie policy. If you are under 16 and wish to give consent to optional services, you must ask your legal guardians for permission. We use cookies and other technologies on our website. Some of them are essential, while others help us to improve this website and your experience. Personal data may be processed (e.g. IP addresses), for example for personalized ads and content or ad and content measurement. You can find more information about the use of your data in our privacy policy. You can revoke or adjust your selection at any time under Settings.

If you are under 16 and wish to give consent to optional services, you must ask your legal guardians for permission. We use cookies and other technologies on our website. Some of them are essential, while others help us to improve this website and your experience. Personal data may be processed (e.g. IP addresses), for example for personalized ads and content or ad and content measurement. You can find more information about the use of your data in our privacy policy. This is an overview of all cookies used on this website. You can either accept all categories at once or make a selection of cookies.