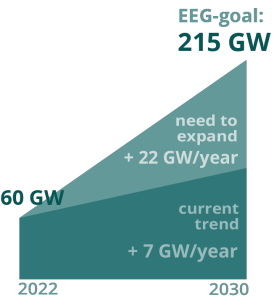

The year 2023 with its extraordinary series of extreme weather events has impressively demonstrated the need to make progress with the energy transformation. There is every reason to worry that the current pace of the transformation may be too slow. Last year, the Germany body politic responded by resolving to set up enough renewable energy sources to cover the country’s entire electricity needs. The photovoltaics strategy adopted by the Federal Government, which includes the Renewable Energy Sources Act (EEG), aims for a generating capacity of 215 Gigawatts (GW) by 2030 from solar energy alone. At present, about seven GW from new PV systems are coming on-stream annually, adding to the 60 GW that existed in 2022.

Growth must increase threefold

Growth must increase threefoldIn order to achieve the quoted target nonetheless, the rate of increase would have to triple, up to around 22 GW annually. For the sake of comparison: The Isar 2 nuclear power plant used to produce 1.49 GW, which made it one of the most productive power plants of its type worldwide. The supply gap is quite evident. Assuming that one Gigawatt is roughly the equivalent of an average nuclear power plant, the PV systems yet to be installed would have to match the output capacity of over 22 nuclear power plants.

The vast roof surfaces of logistics and industrial buildings provide enormous potential in this context. The threshold at which the commercial use of roof surfaces begins to be economically viable for property companies is a roof area of around 5,000 sqm. Based on this size band, the commercially usable roof surface potentially available in Germany adds up to 362.8 million sqm.

By far the biggest potential according to the above parameter is located in North Rhine-Westphalia, the most populous German state. Roughly 82 million sqm of roof surface are available here. Bavaria and Baden-Württemberg offer comparable volumes at 59 million sqm and close to 52 million sqm, respectively. Roof surfaces in Lower Saxony, another large state, add up to almost 42 million sqm. The other German states lag far behind.

Equipping all of these roof surfaces with PV modules would potentially translate into 36 GW of PV capacity in rooftop installations. This is the equivalent of more than 36 average nuclear power plants. Even if the potential was fully exploited, it would cover barely 17% of the required 215 GW, and it should be remembered that some of the logistics warehouses included in the calculated potential may already be contributing to the existing base stock of 60 GW. Still, acting on this potential would be a big step in the right direction.

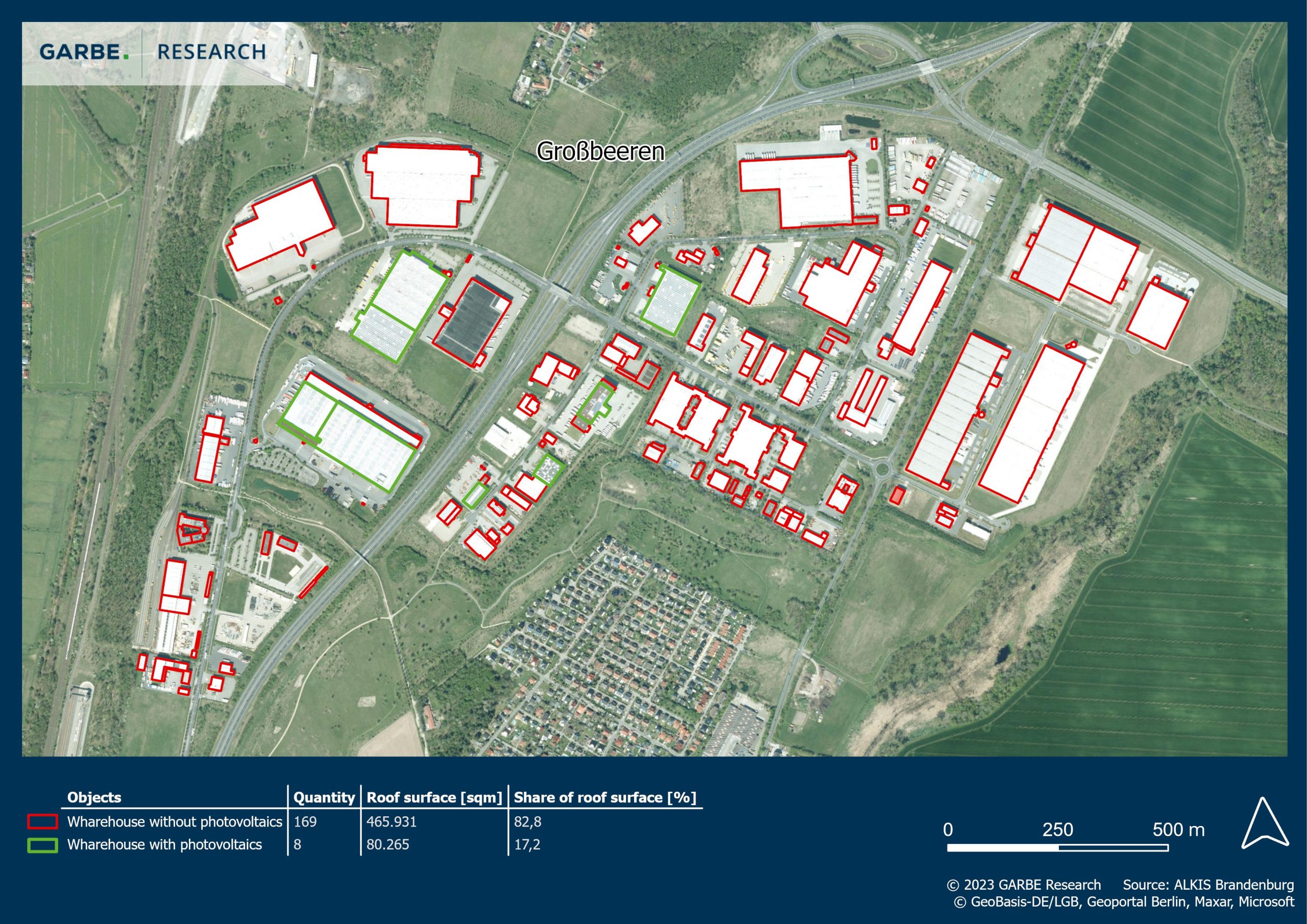

For the time being, however, most of the roofs represent empty expanses. An analysis of Germany’s seven largest logistics agglomerations found that less than 10% of the roof surfaces are equipped with PV modules. The spectrum ranges from 5% in Erfurt to 17% at the GVZ Grossbeeren freight centre south of Berlin. The latter is a rather advanced logistics facility and takes exception with its abundance of newer, larger warehouses which tend to feature PV systems more often than older buildings. That being said, we are still a far cry from the day when new-build developments will come with PV modules as a standard feature. Which is too bad because the new-build warehouse space and, with it, roof surfaces added per year approximate 5-6 million sqm. It is an utter waste of solar power potential.

The sluggish pace of PV installations can be blamed on a wide variety of causes, including the following:

One of the main factors preventing the installation of large-scale photovoltaic systems on commercial roof surfaces is simply the skewed relation of the income from letting roof surfaces for the purpose of operating photovoltaic systems and the rental income from the actual warehouse. Also to be considered in this context is the immense complexity that comes with a PV project. However, operating your own PV system can by all means by lucrative for the owner, especially if the costs of its installation can be financed at a high loan-to-value ratio. But even then, planning, funding and installing PV modules remains a highly complex affair, prompting many warehouse owners to steer clear of such a commitment. This is all the more true whenever the generated electricity is not consumed on the premises but is fed into the grid, because in this case the relevant tariffs have to be acquired at auction from the Federal Network Agency unless a suitable power purchase agreement (PPA) is signed.

It is not always possible or intended to let the occupier of a given facility consume the power generated on its rooftop. In fact, this tends to be the rule whenever large-scale logistics warehouses are at issue and the electricity has to be fed into the local energy utility grid. For any PV system with an output of 1 MWp (about 10,000 sqm of roof surface) or more, German law mandates that a feed-in tariff be acquired at auction. However, the auctions only take place every 3 to 4 months. Once acquired, the tariff marks the lower remuneration limit. The larger the system, the higher its cost effectiveness is likely to be. However, whether or not the generated energy can be fed into the grid at all remains unclear as often as not. In some parts of Germany, the electricity grid is at capacity, and there is no telling whether and when power may be fed in. The information flow and communication in this context can be difficult as well, because you need to make comprehensive arrangements with grid operators, of which there are over 860 in Germany, and you must also clear certain administrative hurdles.

Notwithstanding all the improvements made in recent years, obtaining bank financing for commercial PV systems can at times be tough. As a rule, banks will provide funding for such a system only if an easement for rights to the roof is entered into the land register. This can be problematic insofar as most buildings are already subject to other easements. So, the hierarchy of easements has to be negotiated with the bank who provided the original financing. Assuming this is taken care of, the financing approval depends on whether the system will generate a financially sustainable profit. But this is often impossible to say before a successful grid compatibility test has been completed (see item 2, above) and a feed-in tariff for the electricity grid has been acquired at auction. The larger the array, the higher the profitability and with it the appeal for the financing bank. That is because the acquired tariff is considered the minimum remuneration and thus provides planning certainty. Naturally, the electricity generated may later be purchased and traded by electricity traders on the electricity exchange at rates exceeding the tariff. Electricity traders, too, prefer arrays of the largest possible size. Yet the size of the array, its profitability and its financial feasibility depend in turn on the feed-in options, almost forming a circular relationship that calls for careful coordination.

Warehouse owners tend to worry about damages to the roof membrane during the installation of PV modules which could compromise the water tightness of the buildings, for instance. To be sure, this concern is losing in significance not least because the installations are carried out by experienced professionals familiar with the issue. But a large proportion of the warehouse stock, especially existing buildings, have roofs unsuitable for this kind of use due to structural reasons. Either the load-bearing capacity is simply insufficient or a lack of data makes it difficult to assess the structural load-bearing capacity. Some owners dread the expense of having such documents compiled or structural reviews carried out retroactively, and will commission them only when doing so becomes necessary anyway, e. g. for an imminent disposal. Of course, the installation of the PV system may proceed only if the structural fitness-for-service assessment returns a positive result and if a general contractor capable of installing the system is found. While the availability of components has improved lately, shortages of structural elements continue to be common, slowing PV system construction. Rather than the actual PV modules, current supply issues involve BOS (balance of system) aspects such as superstructures, transformers, inverters and the associated coordination with operators. In the case of stand-alone systems for internal consumption, you need to define metering and measuring concepts that track and document the green power production. Even with the installation completed, power cannot be fed into the grid until a trial run has been conducted and the compliance of the system installation has been confirmed by a certification body. Certifications are currently subject to a waiting period of several months.

The occupant of a given warehouse must be open to the operation of a PV system. This is so not just because the tenant has to grant access to the roof at any time during the installation process. As often as not, the installation makes it necessary for the occupant to give up some space out of the rented area (a so-called carve-out) to make room for superstructures or infrastructure installations, for instance. Especially in the case of triple net leases that delegate responsibility for the roof to the tenant, this can pose a complex obstacle.

Some owners simply prefer not to permit the use of their roof surfaces for PV electricity purposes. Their refusal could be motivated by any of various reasons, e. g. because they wish to use their rooftops as drone landing pads or for another purpose. Rooftops may also be occupied by superstructures such as an attic band whose shadow might compromise their use for PV purposes.

The various stakeholders need to cooperate in order to make the most out of it.In order to accomplish the energy transition and the decarbonisation of the economy and society as a whole, the effort to use rooftops for the production of solar power needs a massive boost. The objective for new-build units should be to integrate PV systems in the planning process from the start. Thus, planning should include the required connections and infrastructure components as well as the necessary load-bearing capacities. The issue of easements could also be addressed early on.

Due to the obstacles outlined above, around 40-50% of the roof surfaces of 362.8 million sqm potentially available on top of existing commercial warehouses fail to qualify for PV purposes. So, the obstacles need to be removed in order to make more of the standing properties fit for service. The proportion of usable roof surfaces should approach 65% or ideally even 80%. This could be achieved if investors could be assured that their generated or potentially producible electricity can be fully fed into the grid and thus be commercialised for the highest minimum remuneration possible.

It is all very well that grid operators are obliged to buy the entire electricity produced after a certain period of time. On the ground, however, it can happen that a grid operator refuses to buy the electricity, and does so without stating a reason or quoting a date by which a feed-in will be possible because a grid connection point (GCP) will only be installed sometime in the future. In this case, it is impossible to plan for anything. In a similar scenario, a utility company may assign a warehouse to a grid connection point that is several kilometres away, so that a cable connection would have to be laid at the owner’s expense. This in turn would necessitate the procurement of permits, the execution of earthworks and the installation of cable routes. The associated costs would erode profitability. These issues can summarily be blamed on Germany’s poorly developed distribution network. The latter should be swiftly and substantially enlarged and upgraded so that the feed-in of PV electricity can be upscaled and designed for profitability.

To make true progress here, owners and investors should have a dedicated in-house expert who takes care of the time-consuming and complex job of working off each of these steps. At the same time, investors are needed that provide the necessary capital. Higher energy prices would help to optimise the cost-to-earnings ratio. Particularly so if they coincided with a drop in component prices for grid transformers, inverters etc. that would bring down the high investment costs. Tightening ESG requirements for owners and occupiers of warehouses would also support the effort by putting the various stakeholders under pressure to reconcile their differences. Another problem is, as always, the excessive amount of “red tape” involved, and it calls for a comprehensive new approach that would, e. g., see the elimination of administrative hurdles and deadlines or the introduction of standards.

Developing 80% of the eligible roof surfaces in Germany would involve EUR 850 per kW in capital expenditures and therefore an investment total of nearly EUR 25 billion. While the associated risks may be daunting for the individual investor, advancing the energy transition via a top-down structural change is a legitimate approach. What is more, it appears to be an achievable objective, not least because the capital would be invested in a far more sustainable and cost-effective scheme than, say, a nuclear power plant whose estimated investment costs run between EUR 7,000 and EUR 12,000 per kW. To say nothing of the downstream costs.

The purpose of this article is, of course, not to point any fingers. Rather, it argues that we need to make a joint effort to exploit as much of the rooftop PV potential as we possibly can. Once this goal is achieved, we will be able to point to the roof and say “not only does it cover the building, it also covers the electric bill.” There is, in any case, no time left to lose.

We use cookies on our site. Some of them are essential, while others help us to improve this website and to show you personalised advertising. You can either accept all or only essential cookies. To find out more, read our privacy policy and cookie policy. If you are under 16 and wish to give consent to optional services, you must ask your legal guardians for permission. We use cookies and other technologies on our website. Some of them are essential, while others help us to improve this website and your experience. Personal data may be processed (e.g. IP addresses), for example for personalized ads and content or ad and content measurement. You can find more information about the use of your data in our privacy policy. You can revoke or adjust your selection at any time under Settings.

If you are under 16 and wish to give consent to optional services, you must ask your legal guardians for permission. We use cookies and other technologies on our website. Some of them are essential, while others help us to improve this website and your experience. Personal data may be processed (e.g. IP addresses), for example for personalized ads and content or ad and content measurement. You can find more information about the use of your data in our privacy policy. This is an overview of all cookies used on this website. You can either accept all categories at once or make a selection of cookies.